The power of Obama’s oratory

By Doyle McManus, Los Angeles Times, February 25, 2009

He needed to spell out and defend his plan for stimulating the economy, which his administration has sometimes stumbled in explaining. He wanted to rally support for the rest of his ambitious domestic program, including expensive investments in healthcare, energy and education. And he sought to lift the mood of the nation by promising that better times lie ahead.

The least concrete of those goals, lifting the nation’s mood, was actually the most important — because it will be difficult for Obama to implement any of his plans if Americans lose hope.

That’s why the first lines from the speech that the White House released in advance Tuesday were these: “While our economy may be weakened and our confidence shaken, though we are living through difficult and uncertain times, tonight I want every American to know this: We will rebuild, we will recover, and the United States of America will emerge stronger than before.”

The obvious comparison is to Franklin D. Roosevelt, who rallied Americans during the Great Depression with his fireside chats, broadcast on the still-new medium of radio.

“There is an element in the readjustment of our financial system more important than currency, more important than gold, and that is the confidence of the people,” Roosevelt said in his first radio speech to the nation in 1933.

But FDR enjoyed a massive, obedient majority in Congress that passed his banking bill in a single day with a minimum of dissent. (As Will Rogers quipped at the time: “Congress doesn’t pass legislation anymore. They just wave at the bills as they go by.”)

With that kind of support, Roosevelt had an easier job, and could aim his speech mostly at persuading citizens to be patient and avoid the urge to withdraw their money from banks.

Obama, in contrast, is asking the public for help in putting pressure on his opponents in Congress.

That’s why the best analogy may not be to Roosevelt but to Ronald Reagan, who turned his presidency into a permanent campaign to rally public support to his side, even when Congress was skeptical. [continued…]

— In a similar sense that Marx understood religion as a product of human suffering, Obama recognizes that his own huge popularity right now is comensurate with the level of fear that pervades America.

Fear is fueling faith as we gamble that our inspirational president is the only hope we have that someone (more than well-crafted policy) can serve as an instrument for our economic salvation.

And since, en masse, human beings have a greater capacity to believe than to doubt, and since an economic turnaround hinges to a significant degree in shifting the balance between pessimism and optimism, there is indeed something extraordinarily fitting that by a simple stroke of luck, America at this particular moment has this particular president.

How spending stimulates

By Brad DeLong, The Week, February 25, 2009

Will the Obama deficit-spending plan work? Will throwing $800 billion—$500 billion in extra government spending, and $300 billion in tax cuts—at the economy produce a world in which production and employment are higher and unemployment lower than would otherwise have been the case?

The short answer is yes. The short reason is that spending works—eras in which some group or other gets excited about future prospects and starts madly spending money are eras in which production and employment are high and unemployment is low. And the government, in this respect, is just like any other group of starry-eyed optimists whose eagerness to spend pulls the economy into a high-employment, high-pressure boom. [continued…]

‘There will be blood’

Niall Ferguson interview, Globe and Mail, February 23, 2009

Heather Scoffield: Will globalization survive this crisis?

Niall Ferguson: It’s a question that’s well worth asking. Because when you look at the way trade has collapsed in the world in the last quarter of 2008 – countries like Taiwan saw their exports fall 45 per cent – that is a depression-style contraction, and we’re in quite early stages of the game at this point. This is before the shock has really played out politically. Before protectionist slogans have really established themselves in the public debate. Buy America is the beginning of something I think we’ll see a lot more of. So I think there’s a real danger that globalization could unravel.

Part of the point I’ve been making for years is that it’s a fragile system. It broke down once before. The last time we globalized the world economy this way, pre-1914, it only took a war to cause the whole thing to come crashing down. Now we’re showing that we can do it without a war. You can cause globalization to disintegrate just by inflating a housing bubble, bursting it, and watching the financial chain reaction unfold.”

Heather Scoffield: Is a violent resolution to this crisis inevitable?

Niall Ferguson: “There will be blood, in the sense that a crisis of this magnitude is bound to increase political as well as economic [conflict]. It is bound to destabilize some countries. It will cause civil wars to break out, that have been dormant. It will topple governments that were moderate and bring in governments that are extreme. These things are pretty predictable. The question is whether the general destabilization, the return of, if you like, political risk, ultimately leads to something really big in the realm of geopolitics. That seems a less certain outcome. We’ve already talked about why China and the United States are in an embrace they don’t dare end. [continued…]

The Obama code

By George Lakoff, The Washington Note, February 24, 2009

For the sake of unity, the President tends to express his moral vision indirectly. Like other self-aware and highly articulate speakers, he connects with his audience using what cognitive scientists call the “cognitive unconscious.” Speaking naturally, he lets his deepest ideas simply structure what he is saying. If you follow him, the deep ideas are communicated unconsciously and automatically. The Code is his most effective way to bring the country together around fundamental American values.

For supporters of the President, it is crucial to understand the Code in order to talk overtly about the old values our new president is communicating. It is necessary because tens of millions of Americans–both conservatives and progressives–don’t yet perceive the vital sea change that Obama is bringing about.

The word “code” can refer to a system of either communication or morality. President Obama has integrated the two. The Obama Code is both moral and linguistic at once. The President is using his enormous skills as a communicator to express a moral system. As he has said, budgets are moral documents. His economic program is tied to his moral system and is discussed in the Code, as are just about all of his other policies. [continued…]

Obama’s faith in ‘non-believers’

By Michael Felsen, The Forward, February 18, 2009

Much has already been said about the reference in Obama’s inaugural address to America as “a nation of Christians and Muslims, Jews and Hindus — and non-believers.” In light of the views of a majority of Americans — who, according to survey data, believe that the United States is a “Christian nation”; feel that it is necessary to believe in God to be a moral person, and say they would not vote for an atheist to serve in our highest public office — the president’s assertion was, in a word, astonishing.

At the February 5 National Prayer Breakfast, the president expanded on this theme. Acknowledging that faith has too often been used as a pretext for prejudice and intolerance, he focused on “the one law that binds all great religions together… the Golden Rule — the call to love one another; to understand one another; to treat with dignity and respect those with whom we share a brief moment on this earth.”

He pointed out that he wasn’t raised in a particularly religious household. His father was born a Muslim and by adulthood had become an atheist; his maternal grandparents were non-practicing Methodists and Baptists; and his mother was “skeptical of organized religion.” Nevertheless, he revealed that this non-religious mother was “the kindest, most spiritual person I’ve ever known,” and was the one who taught him to love, to understand and to do unto others as he would want done unto him. [continued…]

Obama wants to move the center left

By Matt Miller, Wall Street Journal, February 24, 2009

President Barack Obama is taking a beating from liberal critics who think his attempt to court Republican support is a political failure and a policy disaster. Yet this assault on Mr. Obama’s bipartisan instinct is misguided and, ironically, threatens to undermine liberal goals.

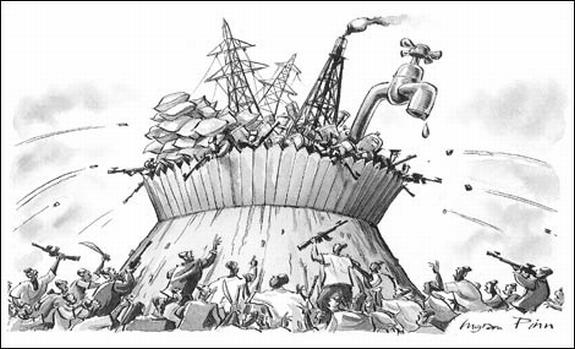

[Commentary] Martin Kozlowski

The president has his eye on a bigger prize than winning a few Republican votes for his stimulus package or having a conservative in his cabinet. He aims to move the political center in America to the left, much as Ronald Reagan moved it to the right. The only way he can achieve this goal is to harness the energies and values of both parties.

Left and right mean less nowadays, especially to Americans outside Washington. But broadly speaking, Mr. Obama seeks to use government in new ways to bolster opportunity and security in an era when financial crisis, global competition and rapid technological change are calling into question the political and business arrangements on which our prosperity has rested for decades. This is the task that history has assigned this president. The spat between him and his liberal critics is about the way one makes this happen. [continued…]

President Barack Obama said he doesn’t “begrudge” the $17 million bonus awarded to JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon or the $9 million issued to Goldman Sachs Group Inc. CEO Lloyd Blankfein, noting that some athletes take home more pay.

President Barack Obama said he doesn’t “begrudge” the $17 million bonus awarded to JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon or the $9 million issued to Goldman Sachs Group Inc. CEO Lloyd Blankfein, noting that some athletes take home more pay.