Category Archives: corporate power

Corporations are not people

Visit msnbc.com for breaking news, world news, and news about the economy

How students landed on the front lines of class war

Juan Cole writes: The deliberate pepper-spraying by campus police of nonviolent protesters at UC Davis on Friday has provoked national outrage. But the horrific incident must not cloud the real question: What led comfortable, bright, middle-class students to join the Occupy protest movement against income inequality and big-money politics in the first place?

The University of California system raised tuition by more than 9 percent this year, and the California State University system upped tuition by 12 percent. The UC system is seriously contemplating a humongous 16 percent tuition increase for fall 2012. This year, for the first time, the amount families pay in UC tuition will exceed state contributions to the university system.

University students, who face tuition hikes and state cuts to public education, find themselves victimized by the same neoliberal agenda that has created the current economic crisis, and which profoundly endangers democratic values.

The ideal that California embraced in its 1960 master plan for higher education, that it should be inexpensive and open to all Californians, is being jettisoned without much debate. The master plan exemplified the thinking on education and democracy typical of Founding Fathers such as Thomas Jefferson. In 1786, Jefferson wrote from Europe to a friend:

Preach, my dear Sir, a crusade against ignorance; establish and improve the law for educating the common people. Let our countrymen know that the people alone can protect us against these evils [of tyranny], and that the tax which will be paid for this purpose is not more than the thousandth part of what will be paid to kings, priests and nobles who will rise up among us if we leave the people in ignorance. …

That is, Jefferson believed that the alternative to publicly funded education was the rise of an oppressive oligarchy that would manipulate the ignorant majority.

Inside the corporate plan to occupy the Pentagon

Adam Weinstein reports: With time fast running out for the so-called deficit supercommittee, the mammoth amount of government money spent on the military has become a prime target in Washington. But the main focus isn’t on big-ticket weapons projects or expensive wars—it’s on retirement benefits for the roughly 17 percent of soldiers, Marines, sailors, and airmen who have served 20 years or more in uniform. Currently the total cost of their benefits is about $50 billion a year.

Cuts to military pensions are “the kind of thing you have to consider,” Defense Secretary Leon Panetta said in September. When President Obama unveiled his $3 trillion debt reduction plan the same month, it called GIs’ benefits “out of line” with private employee retirement plans, saying the system was “designed for a different era of work.” When Congress held a hearing on military retirements in October, Rep. Austin Scott (R-Ga.) promoted a cheaper 401(k)-style plan that would slash existing benefits for many troops. “I see nothing wrong with them being able to choose a different retirement plan,” he said.

These ideas may sound like a bold new approach in an urgent moment—but in fact, the push for pension cuts and other corporate “reforms” at the Pentagon originates from an obscure advisory panel that has existed for a decade: the Defense Business Board. Its 21 members know little about military affairs, but they are rich in Wall Street experience, including with some of the biggest companies implicated in the 2008 financial meltdown. They are investment bank CEOs and CFOs, outsourcing experts, and layoff specialists who promote a corporate agenda of “behavior change” and “business solutions” [PDF] in the military bureaucracy. The board proposes not only to slash and privatize military pensions, but also to have the Pentagon invest in oil futures, boost pay for its executives and political appointees, and make it easier for them to fire rank-and-file employees while scaling back those workers’ collective-bargaining rights.

Indeed, “this sounds like what’s being done now around the country with the public unions,” affirms Charles Tiefer, a University of Baltimore law professor and defense contracting watchdog who’s testified to Congress about the board’s recommendations. The board was launched in 2001 by then Defense Secretary Donald Rumsfeld, who famously wanted to downsize the military and corporatize its management system. The essential reason it exists, Tiefer says, is so that “a pro-business attitude—especially on personnel issues—remains intact” inside the Pentagon.

Bill McKibben, Keystone XL, and Barack Obama

Jane Mayer writes: Last spring, months before Wall Street was Occupied, civil disobedience of the kind sweeping the Arab world was hard to imagine happening here. But at Middlebury College, in Vermont, Bill McKibben, a scholar-in-residence, was leading a class discussion about Taylor Branch’s trilogy on Martin Luther King, Jr., and he began to wonder if the tactics that had won the civil-rights battle could work in this country again. McKibben, who is an author and an environmental activist (and a former New Yorker staff writer), had been alarmed by a conversation he had had about the proposed Keystone XL oil pipeline with James Hansen, the head of NASA’s Goddard Institute for Space Studies, and one of the country’s foremost climate scientists. If the pipeline was built, it would hasten the extraction of exceptionally dirty crude oil, using huge amounts of water and heat, from the tar sands of Alberta, Canada, which would then be piped across the United States, where it would be refined and burned as fuel, releasing a vast new volume of greenhouse gas into the atmosphere. “What would the effect be on the climate?” McKibben asked. Hansen replied, “Essentially, it’s game over for the planet.”

It seemed a moment when, literally, a line had to be drawn in the sand. Crossing it, environmentalists believed, meant entering a more perilous phase of “extreme energy.” The tar sands’ oil deposits may be a treasure trove second in value only to Saudi Arabia’s, and the pipeline, as McKibben saw it, posed a powerful test of America’s resolve to develop cleaner sources of energy, as Barack Obama had promised to do in the 2008 campaign.

But TransCanada, the Canadian company proposing the project, was already two years into the process of applying for the necessary U.S. permit. The decision, which was expected by the end of this year, would ultimately be made by Obama, but, because the pipeline would cross an international border, the State Department had the lead role in evaluating the project, and Secretary of State Hillary Clinton had already indicated that she was “inclined” to approve it. Both TransCanada and the Laborers’ International Union of North America touted the construction jobs that the pipeline would create and the national-security bonus that it would confer by replacing Middle Eastern oil with Canadian.

The lineup promoting TransCanada’s interests was a textbook study in modern, bipartisan corporate influence peddling. Lobbyists ranged from the arch-conservative Grover Norquist’s Americans for Tax Reform to TransCanada’s in-house lobbyist Paul Elliott, who worked on both Hillary and Bill Clinton’s Presidential campaigns. President Clinton’s former Ambassador to Canada, Gordon Giffin, a major contributor to Hillary Clinton’s Presidential and Senate campaigns, was on TransCanada’s payroll, too. (Giffin says that he has never spoken to Secretary Clinton about the pipeline.) Most of the big oil companies also had a stake in the project. In a recent National Journal poll of “energy insiders,” opinion was virtually unanimous that the project would be approved.

Lobbyists plan to defend Wall Street and attack the Occupy movement

Visit msnbc.com for breaking news, world news, and news about the economy

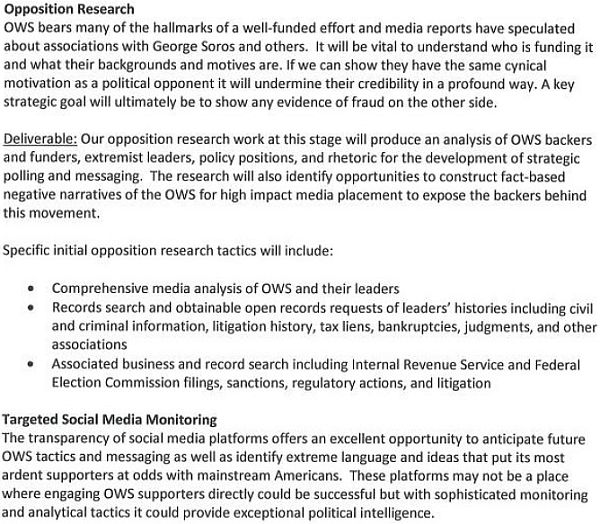

MSNBC reports: A well-known Washington lobbying firm with links to the financial industry has proposed an $850,000 plan to take on Occupy Wall Street and politicians who might express sympathy for the protests, according to a memo obtained by the MSNBC program “Up w/ Chris Hayes.”

The proposal was written on the letterhead of the lobbying firm Clark Lytle Geduldig & Cranford and addressed to one of CLGC’s clients, the American Bankers Association.

CLGC’s memo [PDF] proposes that the ABA pay CLGC $850,000 to conduct “opposition research” on Occupy Wall Street in order to construct “negative narratives” about the protests and allied politicians. The memo also asserts that Democratic victories in 2012 would be detrimental for Wall Street and targets specific races in which it says Wall Street would benefit by electing Republicans instead.

According to the memo, if Democrats embrace OWS, “This would mean more than just short-term political discomfort for Wall Street. … It has the potential to have very long-lasting political, policy and financial impacts on the companies in the center of the bullseye.”

Here’s an extract from the memo:

Rep. Deutch introduces OCCUPIED constitutional amendment to ban corporate money in politics

Zaid Jilani reports: In one of the greatest signs yet that the 99 Percenters are having an impact, Rep. Ted Deutch (D-FL), a member of the House Judiciary Committee, today introduced an amendment that would ban corporate money in politics and end corporate personhood once and for all.

Deutch’s amendment, called the Outlawing Corporate Cash Undermining the Public Interest in our Elections and Democracy (OCCUPIED) [PDF] Amendment, would overturn the Citizens United decision, re-establishing the right of Congress and the states to regulate campaign finance laws, and to effectively outlaw the ability of for-profit corporations to contribute to campaign spending.

“No matter how long protesters camp out across America, big banks will continue to pour money into shadow groups promoting candidates more likely to slash Medicaid for poor children than help families facing foreclosure,” said Deutch in a statement provided to ThinkProgress. “No matter how strongly Ohio families fight for basic fairness for workers, the Koch Brothers will continue to pour millions into campaigns aimed at protecting the wealthiest 1%. No matter how fed up seniors in South Florida are with an agenda that puts oil subsidies ahead of Social Security and Medicare, corporations will continue to fund massive publicity campaigns and malicious attack ads against the public interest. Americans of all stripes agree that for far too long, corporations have occupied Washington and drowned out the voices of the people. I introduced the OCCUPIED Amendment because the days of corporate control of our democracy. It is time to return the nation’s capital and our democracy to the people.”

Lessons of the Luddites

Eliane Glaser writes: Two hundred years ago this month, groups of artisan cloth workers began to assemble at night on the moors around towns in Nottinghamshire. Proclaiming allegiance to the mythical King Ludd of Sherwood Forest, and sometimes subversively cross-dressed in frocks and bonnets, the Luddites organised machine-wrecking raids on textile factories that quickly spread across the north of England. The government mobilised the army and made frame breaking a capital offence: the uprisings were subdued by the summer of 1812.

Contrary to modern assumptions, the Luddites were not opposed to technology itself. They were opposed to the particular way it was being applied. After all, stocking frames had been around for 200 years by the time the Luddites came along, and they weren’t the first to smash them up. Their protest was specifically aimed at a new class of manufacturers who were aggressively undermining wages, dismantling workers’ rights and imposing a corrosive early form of free trade. To prove it, they selectively destroyed the machines owned by factory managers who were undercutting prices, leaving the other machines intact.

The original Luddites enjoyed strong local backing as well as high-profile support from Lord Byron and Mary Shelley, whose novel Frankenstein alludes to the industrial revolution’s dark side. But in the digital age, Luddism as a position is barely tenable. Just as we assume that the original Luddites were simply technophobes, it’s become unthinkable to countenance any broader political objections to contemporary technology’s direction of travel.

The promoters of internet technology combine visionary enthusiasm and like-it-or-not realism. So dissent is dismissed as either an irrational rejection of progress or a refusal to face the inevitable. It’s the realism that’s particularly hard to counter; the notion that technology is an unstoppable and non-negotiable force entirely separate from human agency. There’s not much time for political critique if you’re constantly being told that “the world is changing fast and you have to keep up”. Which is a bit rich given that politics infuses the arguments of even technology’s purest advocates.

As Slavoj Žižek has noted, the language of internet advocacy – phrases like “the unlimited flow of information” and “the marketplace of ideas” – mirrors the language of free-market economics. But techno-prophets also use the lingo of leftwing revolution. It’s there in books such as James Surowiecki’s The Wisdom of Crowds and Clay Shirky’s Here Comes Everybody, and in Vodafone’s slogan, “Power to You”; in the notion that blogs, Twitter and newspaper comment threads create a level playing field in the public debate; and it’s there in the countless magazine features about how the internet fosters grassroots protest, places the tools of cultural production in amateurs’ hands, and allows the little guy immediate access to information that keeps political leaders on their toes. This is not Adam Smith, it’s Marx and Mao.

In fact, both rhetorics – of the free market and of bottom-up emancipation – serve to conceal the rise of crony capitalism and the concentration of power and money at the top. Google is busily acquiring “all the world’s information”. Facebook is gathering our personal data for the coming world of personalised advertising. Amazon is monopolising the book trade. The abandonment of net neutrality means corporate control of the web. Once all our books, music, pictures and information are stored in the cloud, it will be owned by a handful of conglomerates.

“We can’t let the banks rewrite history”

Michael Powell writes: The Bank of America lawyer laid down a patented rhetorical move heard in courts across America. Your Honor, this Orange County, N.Y., homeowner — a New York City police officer — didn’t make enough money to qualify for a mortgage modification. He didn’t send us the right documents.

He didn’t, he didn’t, he didn’t, and so we should be allowed to foreclose.

Justice Catherine M. Bartlett of New York State Supreme Court cut off the lawyer. You, she said, are telling me lies.

“Bank of America got a bailout, and this is an outrage, how this man has been treated,” she said. “Hard-working, middle-class Americans are trying to make it, trying to refinance with your bank.”

Either bank officials show up in person, the justice said, or I’m going to order them “here in handcuffs.”

Rage has acquired a cleansing power. Patience as a virtue is a hard sell at the burnt end of a four-year economic collapse. Zuccotti Park shakes, rattles and rolls; television yakkers chat about inequality; and the federal judge Jed Rakoff all but heckled the Securities and Exchange Commission last week for going easy on Citigroup misbehavior.

Then there is Eric T. Schneiderman, New York’s attorney general, caught in Month 5 of a face-off with the White House. President Obama dearly wants to seal a deal in which the nation’s largest banks toss over a few bales of cash — $20 billion to help with foreclosure relief — and the state attorneys general agree not to pursue sprawling and explosive legal cases against the banks.

Mr. Schneiderman and Attorney General Beau Biden of Delaware, joined by a few others, say no. Banks, they say, should disgorge more documents, testify more precisely and prove more completely that they own millions of mortgage notes. These rebel attorneys general want the banks to hand over more than $200 billion, which would enable the government to write down tens of millions of mortgages.

But in the end, their argument is elemental: Wouldn’t the nation benefit from knowing the truth about the behavior of banks and bankers?

The Occupy movements are the realists, not the ruling elites

John Gray writes: The Occupy movements have been attacked for being impractical visionaries. In fact it is the established political classes of the west that are wedded to utopian thinking, while the protesters are recalling us to the actualities of human experience. Based on economic theories that left out human beings, the global free market was supposed to be self-regulating. Now a process of disintegration is under way, in which the structures set up in the post-cold-war period are visibly breaking up.

Anyone with a smattering of history could see that the hubristic capitalism of the past 20 years was programmed to self-destruct. The notion that the world’s disparate societies could be corralled into a worldwide free market was always a dangerous fantasy. Opening up economies throughout the world meant ordinary people were more directly exposed to the gyrations of market forces than they had been for generations. As it overthrew existing patterns of life and robbed large numbers of people of any security they might have achieved, global capitalism was bound to trigger a powerful blowback.

For as long as it was able to engineer an illusion of increasing prosperity, free-market globalisation was politically invulnerable. When the bubble burst, the actual condition of the majority was laid bare. In the US a plantation-style economy has come into being, with debt-servitude for the many coexisting with extremes of volatile wealth for the few. In Europe the muddled dream of a single currency has resulted in social devastation in Greece, mass unemployment in Spain and other countries, and even, for some, reversion to a life based on barter: sucking society into a vortex of debt deflation, austerity policies are driving a kind of reverse economic development. In many countries a settled bourgeois existence – supposedly the basis of popular capitalism – has become an impossible aspiration. Large numbers are edging closer to poverty and a life without hope.

History tells us how perilous this process can be. It has been taken for granted that a sudden collapse of the kind that occurred in the former Soviet Union and more recently Egypt cannot happen in advanced market economies. That assumption may be tested severely in coming years. While totalitarian mass movements of the sort seen in the 30s are not going to return, Europe’s demons have not gone away. Blaming minorities and immigrants is a perennially popular response to economic dislocation, and ethnic nationalism can be hideously destructive. In the US the continuing demise of the middle class could engender a style of politics even more rancorous and unhinged than that prevailing today. A figure such as Father Coughlin, the Depression-era radio demagogue, shows what can be expected as the economy continues its slide. With the rise of trigger-happy politicians like Mitt Romney and the need for Obama to act tough, it would be unwise to rule out the prospect of another major war.

The new progressive movement

Jeffrey Sachs writes: Twice before in American history, powerful corporate interests dominated Washington and brought America to a state of unacceptable inequality, instability and corruption. Both times a social and political movement arose to restore democracy and shared prosperity.

The first age of inequality was the Gilded Age at the end of the 19th century, an era quite like today, when both political parties served the interests of the corporate robber barons. The progressive movement arose after the financial crisis of 1893. In the following decades Theodore Roosevelt and Woodrow Wilson came to power, and the movement pushed through a remarkable era of reform: trust busting, federal income taxation, fair labor standards, the direct election of senators and women’s suffrage.

The second gilded age was the Roaring Twenties. The pro-business administrations of Harding, Coolidge and Hoover once again opened up the floodgates of corruption and financial excess, this time culminating in the Great Depression. And once again the pendulum swung. F.D.R.’s New Deal marked the start of several decades of reduced income inequality, strong trade unions, steep top tax rates and strict financial regulation. After 1981, Reagan began to dismantle each of these core features of the New Deal.

Following our recent financial calamity, a third progressive era is likely to be in the making. This one should aim for three things. The first is a revival of crucial public services, especially education, training, public investment and environmental protection. The second is the end of a climate of impunity that encouraged nearly every Wall Street firm to commit financial fraud. The third is to re-establish the supremacy of people votes over dollar votes in Washington.

None of this will be easy. Vested interests are deeply entrenched, even as Wall Street titans are jailed and their firms pay megafines for fraud. The progressive era took 20 years to correct abuses of the Gilded Age. The New Deal struggled for a decade to overcome the Great Depression, and the expansion of economic justice lasted through the 1960s. The new wave of reform is but a few months old.

The young people in Zuccotti Park and more than 1,000 cities have started America on a path to renewal. The movement, still in its first days, will have to expand in several strategic ways. Activists are needed among shareholders, consumers and students to hold corporations and politicians to account. Shareholders, for example, should pressure companies to get out of politics. Consumers should take their money and purchasing power away from companies that confuse business and political power. The whole range of other actions — shareholder and consumer activism, policy formulation, and running of candidates — will not happen in the park.

The new movement also needs to build a public policy platform. The American people have it absolutely right on the three main points of a new agenda. To put it simply: tax the rich, end the wars and restore honest and effective government for all.

Finally, the new progressive era will need a fresh and gutsy generation of candidates to seek election victories not through wealthy campaign financiers but through free social media. A new generation of politicians will prove that they can win on YouTube, Twitter, Facebook and blog sites, rather than with corporate-financed TV ads. By lowering the cost of political campaigning, the free social media can liberate Washington from the current state of endemic corruption. And the candidates that turn down large campaign checks, political action committees, Super PACs and bundlers will be well positioned to call out their opponents who are on the corporate take.

Those who think that the cold weather will end the protests should think again. A new generation of leaders is just getting started. The new progressive age has begun.

Finally, a judge stands up to Wall Street

Matt Taibbi writes: Federal judge Jed Rakoff, a former prosecutor with the U.S. Attorney’s office here in New York, is fast becoming a sort of legal hero of our time. He showed that again yesterday when he shat all over the SEC’s latest dirty settlement with serial fraud offender Citigroup, refusing to let the captured regulatory agency sweep yet another case of high-level criminal malfeasance under the rug.

The SEC had brought an action against Citigroup for misleading investors about the way a certain package of mortgage-backed assets had been chosen. The case is very similar to the notorious Abacus case involving Goldman Sachs, in which Goldman allowed short-selling billionaire John Paulson (who was betting against the package) to pick the assets, then told a pair of European banks that the “designed to fail” package they were buying had been put together independently.

This case was similar, but worse. Here, Citi similarly told investors a package of mortgages had been chosen independently, when in fact Citi itself had chosen the stuff and was betting against the whole pile.

This whole transaction actually combined a number of Goldman-style misdeeds, since the bank both lied to investors and also bet against its own product and its own customers. In the deal, Citi made a $160 million profit, while its customers lost $700 million.

Goldman, in the Abacus case, got fined $550 million. In this worse case, the SEC was trying to settle with Citi for just $285 million. Judge Rakoff balked at the settlement and particularly balked at the SEC’s decision to allow Citi off without any admission of wrongdoing. He also mocked the SEC’s decision to describe the crime as “negligence” instead of intentional fraud, taking the entirely rational position that there’s no way a bank making $160 million ripping off its customers can conceivably be described as an accident.

“Why should the court impose a judgment in a case in which the SEC alleges a serious securities fraud but the defendant neither admits nor denies wrongdoing?” And this: “How can a securities fraud of this nature and magnitude be the result simply of negligence?”

Rakoff of course is right – the settlement is nuts. If you take Citi’s $160 million profit on the deal into consideration, what we’re talking about then is a $125 million fine for causing $700 million in damages. That, and no admission of wrongdoing.

Just imagine a mugger who steals $70 from some lady’s wallet being sentenced to walk free after paying back twelve bucks. Magritte himself could not devise a more surreal take on criminal justice.

Bill Moyers: ‘They are occupying Wall Street because Wall Street is occupying America

Bill Moyers says: The great American experience in creating a different future together — this “voluntary union for the common good” – has been flummoxed by a growing sense of political impotence — what the historian Lawrence Goodwyn has described as a mass resignation of people who believe “the dogma of democracy” on a superficial public level but who no longer believe it privately. There has been, he writes, a decline in what people think they have a political right to aspire to — a decline of individual self-respect on the part of millions of people.

You can understand why that is. We hold elections, knowing they are unlikely to produce the policies favored by a majority of Americans. We speak, we write, we advocate — and those in power, Democrats and Republicans, liberals and conservatives, turn deaf ears and blind eyes to our deepest aspirations. We petition, we plead, we even pray — yet the Earth that is our commons and should be passed on in good condition to coming generations, continues to be despoiled. We invoke the strain in our national DNA that attests to “life, liberty, and the pursuit of happiness” as the produce of political equality — yet private wealth multiplies even as public goods are beggared.

And the property qualifications for federal office that the framers of the Constitution expressly feared as an unseemly “veneration for wealth” are now openly in force and the common denominator of public office, including for our judges, is a common deference to cash.

So if belief in the “the dogma of democracy” seems only skin deep, there are reasons for it.

During the great prairie revolt that swept the plains a century after the Constitution was ratified, the populist orator Mary Elizabeth Lease explained “Wall Street owns the country. Our laws are the output of a system which clothes rascals in robes and honesty in rags. The parties lie to us, and the political speakers mislead us,” because, she said, “money rules.”

That was 1890. And those agrarian populists were boiling over with anger that the corporations, banks and government were conniving to deprive everyday people of their livelihood. They should see us now.

John Boehner calls on the bankers, holds out his cup, and offers them total obeisance from the House majority if only they will fill it. That’s now the norm, and they get away with it.

Barack Obama criticizes bankers as fat cats, then invites them to dine at a pricy New York restaurant where the tasting menu runs to $195 a person. And that’s the norm. And they get away with it.

As we speak, the president has raised more money from banks, hedge funds, and private equity managers than any Republican candidate, including Mitt Romney. Let’s name it for what it is: democratic deviancy defined downward. Politics today — and there are honorable men and women in it — but politics today is little more than money laundering and the trafficking of power and policy, fewer than six degrees of separation from the spirit and tactics of Tony Soprano.

Why New York’s Zuccotti Park is occupied is no mystery — reporters keep scratching their heads and asking, “Why are you here?” But it’s as clear as the crash of 2008: they are occupying Wall Street because Wall Street has occupied America.

Biggest public firms paid little U.S. tax, study says

The New York Times reports: Warren E. Buffett, take note. It is not just a few wealthy individuals paying unusually low taxes to the federal government. Corporate America is not far behind.

A comprehensive study released on Thursday found that 280 of the biggest publicly traded American companies faced federal income tax bills equal to 18.5 percent of their profits during the last three years — little more than half the official corporate rate of 35 percent and lower than their competitors in many industrialized countries.

Mr. Buffett, the billionaire investor, has said that the tax code is unfair, allowing him to pay just 17 percent in federal taxes last year, about half the percentage his secretary paid.

The corporate study, prepared by the left-leaning advocacy group Citizens for Tax Justice, examined the regulatory filings of the companies to compute each year’s current federal taxes. Some of the companies disputed the findings, saying that the study understated their tax payments by omitting deferred taxes that they may pay in future years.

Using information from the companies’ own corporate filings, however, the study concluded that a quarter of the 280 corporations owed less than 10 percent of profits in federal income taxes and 30 companies had no federal tax liability for the entire three-year period.