Andrew Scott Cooper writes: For the past half-century, the world economy has been held hostage by just one country: the Kingdom of Saudi Arabia. Vast petroleum reserves and untapped production allowed the kingdom to play an outsize role as swing producer, filling or draining the global system at will.

The 1973-74 oil embargo was the first demonstration that the House of Saud was willing to weaponize the oil markets. In October 1973, a coalition of Arab states led by Saudi Arabia abruptly halted oil shipments in retaliation for America’s support of Israel during the Yom Kippur War. The price of a barrel of oil quickly quadrupled; the resulting shock to the oil-dependent economies of the West led to a sharp rise in the cost of living, mass unemployment and growing social discontent.

“If I was the president,” Secretary of State Henry Kissinger fumed to his deputy Brent Scowcroft, “I would tell the Arabs to shove their oil.” But the president, Richard M. Nixon, was in no position to dictate to the Saudis.

In the West, we have largely forgotten the lessons of 1974, partly because our economies have changed and are less vulnerable, but mainly because we are not the Saudis’ principal target. Predictions that global oil production would eventually peak, ensuring prices stayed permanently high, never materialized. Today’s oil crises are determined less by the floating price of crude than by crude regional politics. The oil wars of the 21st century are underway. [Continue reading…]

Category Archives: fossil fuels

Surge in renewable energy stalls world greenhouse gas emissions

The Guardian reports: Falling coal use in China and the US and a worldwide shift towards renewable energy have kept greenhouse gas emissions level for a second year running, one of the world’s leading energy analysts has said.

Preliminary data from the International Energy Agency (IEA) showed that carbon dioxide emissions from the energy sector have levelled off at 32.1bn tonnes even as the global economy grew over 3% .

Electricity generated by renewable sources played a critical role, having accounted for around 90% of new electricity generation in 2015. Wind power produced more than half of all new electricity generation, said the IEA. [Continue reading…]

Michael Klare: A take-no-prisoners world of oil

It’s evident that we’re still on a planet where oil rules. The question increasingly is: What exactly does it rule over? After all, every barrel of oil that’s burned contributes to a fast-approaching future in which the weather grows hotter and more extreme, droughts and wildfires spread, sea levels rise precipitously, ice continues to melt away in the globe’s coldest reaches, and… well, you know that story well enough by now. In the meantime, Planet Earth has a glut of oil on hand and that, it turns out, doesn’t mean — not for the major oil companies nor even for the major oil states — that the good times are getting ready to roll.

Of all the powers struggling with that oil glut and the plunging energy prices that have gone with it, none may be more worth watching than Saudi Arabia. While exporting its own extremists and its extreme brand of Islam from Afghanistan to Syria, and lending a decades-long hand to the destabilization of the Greater Middle East, that kingdom has itself been a paragon of stability. Nothing, however, lasts forever, and so keeping an eye on the Saudis is a must. That’s especially so since the latest version of the royal family has also made what might be called the American mistake (with the backing of the Obama administration, no less) and for the first time plunged the Saudi military directly into a typically unwinnable if brutal war in neighboring Yemen. Combine the destabilizing and blowback effects of wars that won’t end, including the Syrian one, and of oil prices that refuse to rise significantly and, despite the kingdom’s copious money reserves, you have a formula for potential domestic unrest. Already the royals are cutting their domestic subsidies to their own population, pulling billions of dollars in aid out of Lebanon, and exploring a possible $10 billion bank loan.

As TomDispatch’s invaluable energy expert Michael Klare suggests today, when oil prices began plummeting in 2015, the Saudis launched an “oil war of attrition,” imagining that others would be devastated by it (as OPEC partners Nigeria and Venezuela already have been) but that the royals themselves would emerge triumphant. Should the unimaginable happen, however, and should the kingdom itself begin to come unglued in a Greater Middle East that is increasingly the definition of chaos — watch out. Tom Engelhardt

Energy wars of attrition

The irony of oil abundance

By Michael T. KlareThree and a half years ago, the International Energy Agency (IEA) triggered headlines around the world by predicting that the United States would overtake Saudi Arabia to become the world’s leading oil producer by 2020 and, together with Canada, would become a net exporter of oil around 2030. Overnight, a new strain of American energy triumphalism appeared and experts began speaking of “Saudi America,” a reinvigorated U.S.A. animated by copious streams of oil and natural gas, much of it obtained through the then-pioneering technique of hydro-fracking. “This is a real energy revolution,” the Wall Street Journal crowed in an editorial heralding the IEA pronouncement.

The most immediate effect of this “revolution,” its boosters proclaimed, would be to banish any likelihood of a “peak” in world oil production and subsequent petroleum scarcity. The peak oil theorists, who flourished in the early years of the twenty-first century, warned that global output was likely to reach its maximum attainable level in the near future, possibly as early as 2012, and then commence an irreversible decline as the major reserves of energy were tapped dry. The proponents of this outlook did not, however, foresee the coming of hydro-fracking and the exploitation of previously inaccessible reserves of oil and natural gas in underground shale formations.

Women of the Amazon defend their homeland against new oil contract

Emily Arasim and Osprey Orielle Lake report: In late January 2016, the government of Ecuador signed a controversial contract with Chinese oil company Andes Petroleum, handing over rights to explore and drill for oil deep in the country’s pristine southeastern Amazon Rainforest, known and revered by many as “the lungs of the Earth.”

For decades, Indigenous communities of the southern Ecuadorian Amazon have successfully fought to protect their land from encroachment by oil companies, engaging in local action and international policymaking and campaigns with a powerful message of respect for the Earth’s natural laws and the rights of Indigenous peoples.

At the forefront of this ongoing struggle are courageous Indigenous Amazonian women leaders who have declared, “We are ready to protect, defend and die for our forest, families, territory and nation.”

In marches, protests, conferences and international forums, the women of the Ecuadorian Amazon are standing with fierce love and conviction for the forests and their communities, and navigating a brutal intersection of environmental devastation, cultural dislocation and violence and persecution as women human rights and land defenders.

The women have repeatedly put their bodies on the frontline in an attempt to halt oil extraction across the Amazon, often facing harsh repression by the state security. [Continue reading…]

As Utah coal slumps, solar energy booms

Deseret News reports: The sun is becoming big business in Utah.

Whether it’s in the sun-drenched deserts of Dixie or the sometimes smoggy valleys of northern Utah, more and more homeowners are taking the plunge and betting that solar energy will pay off for them in the future.

The boom has pushed employment in Utah’s solar industry to a point well beyond the job numbers in a more traditional energy sector, Utah’s coal industry.

“Well, I figured I should just own my own power,” said Kerry Zacher, a Centerville man who got his rooftop solar system up and running at the end of September. “I got sick of paying high electric bills.”

He saw immediate benefits.

“September’s bill was roughly 150 dollars,” Zacher said. “October? Nine. Nine dollars.”

Zacher monitors the energy production from his solar panels with an app on his cellphone. He’s already learned that in northern Utah, there are good days as well as occasional very poor days when there’s not enough sunshine to provide for his power needs. On those days he has to rely on power from the grid. On sunny days, though, he often produces excess power that is traded back to the grid. [Continue reading…]

U.S. government agency says it has beaten Elon Musk and Bill Gates to holy grail of battery storage

The Guardian reports: A US government agency says it has attained the “holy grail” of energy – the next-generation system of battery storage, that has has been hotly pursued by the likes of Bill Gates and Elon Musk.

Advanced Research Projects Agency-Energy (Arpa-E) – a branch of the Department of Energy – says it achieved its breakthrough technology in seven years.

Ellen Williams, Arpa-E’s director, said: “I think we have reached some holy grails in batteries – just in the sense of demonstrating that we can create a totally new approach to battery technology, make it work, make it commercially viable, and get it out there to let it do its thing,”

If that’s the case, Arpa-E has come out ahead of Gates and Musk in the multi-billion-dollar race to build the next generation battery for power companies and home storage.

Arpa-E was founded in 2009 under Barack Obama’s economic recovery plan to fund early stage research into the generation and storage of energy.

Such projects, or so-called moonshots, were widely seen as too risky for regular investors, but – if they succeed – could potentially be game-changing. [Continue reading…]

China set to surpass its climate targets as renewables soar

New Scientist reports: China is surging ahead in switching to renewables and away from coal in what its officials say will allow it to surpass its carbon emissions targets.

The country’s solar and wind energy capacity soared last year by 74 and 34 per cent respectively compared with 2014, according to figures issued by China’s National Bureau of Statistics yesterday.

Meanwhile, its consumption of coal – the dirtiest of the fossil fuels – dropped by 3.7 per cent, with imports down by a substantial 30 per cent.

The figures back up claims last month in Hong Kong by Xie Zhenhua, China’s lead negotiator at at the UN climate talks in Paris last December, that the country will “far surpass” its 2020 target to reduce carbon emissions per unit of national wealth (GDP) by 40 to 45 per cent from 2005 levels. [Continue reading…]

If the Kurds go broke, it’s lights out for Obama’s war on ISIS

John Hannah writes: Here’s a worrying bit of news: America’s best ally in the war against the Islamic State, Iraq’s Kurdistan Regional Government (KRG), is nearly broke. That’s a major problem, especially as the U.S.-led coalition gears up for its most difficult battle yet: the effort to liberate Mosul, the heart of the Islamic State’s power in Iraq. With the Kurds slated to play an essential role in that potentially decisive military campaign, now is the time for their capabilities to be reaching their zenith. Instead, they’re under growing threat of catastrophic collapse.

A near-perfect storm of crises has been draining KRG finances. First, there’s the burden of the war. For over 18 months, Kurdish forces have been pushing IS back across a 600-mile front. There’s also the KRG’s chronic dispute with the central government in Baghdad that has denied the region its share of Iraq’s national budget for the better part of two years. That’s billions upon billions of dollars in foregone revenue.

Further exacerbating the situation has been a massive influx of refugees and displaced persons, an estimated 1.8 million men, women, and children, fleeing the Islamic State’s hordes for the relative safety of Kurdistan. That tidal wave of humanity has increased the region’s population by an astounding 30 percent, straining its infrastructure and social services to the breaking point (just think about that: in the United States, that’s the equivalent of trying to take in over 90 million people overnight). Finally, like oil producers everywhere, what earnings the KRG receives from its own energy exports have been decimated by the collapse in world prices.

This can’t end well. The warning signs are everywhere. Up to 70 percent of Kurdistan’s workforce is on the KRG’s payroll. Most have not been paid for months. When back wages finally come through, it’s often at a fraction of what’s owed. Going forward, officials have dangled the threat of draconian salary cuts. Labor strikes are breaking out, involving teachers, medical workers, and even elements of the police. Political tensions are escalating. The broader economy is grinding to a halt. Construction of schools, hospitals, roads, and other critical infrastructure, is stalled. Tourism has dried up. Property values have plummeted. Consumer spending is collapsing.

Even more worrisome is the impact on Kurdistan’s oil sector, overwhelmingly the KRG’s primary source of revenue. The small international firms responsible for most of the region’s exports have received only sporadic payments. Absent these funds, the companies largely lack the necessary cash flow to invest in further developing existing fields. And without sufficient capital expenditures, production at these fields could actually begin to decline. New exploration, meanwhile, is at a virtual standstill, with the region’s rig count down by more than 90 percent, reaching levels not seen since the first production contracts were signed more than a decade ago. [Continue reading…]

Foreign Policy reports: Iraqi Kurds’ dreams of energy-financed political independence are taking a beating — and not just because of low oil prices.

Since the middle of February, Iraqi Kurdistan’s tenuous export link to the outside world has been totally shut down. As recently as January, the Kurds were exporting 600,000 barrels a day in exchange for desperately needed revenue. But the mysterious closure of the pipeline that connects Kurdish refineries to the Turkish coast has brought that number to essentially zero.

Kurdish officials say they don’t know for sure why the pipeline has been shut down; theories range from a terrorist bombing to simple sabotage to a precautionary shutdown by Turkish authorities carrying out big military operations in the area.

What’s crystal clear is that a region dependent on oil export revenues — one that was already struggling mightily to make ends meet during its costly war against the Islamic State — now has its back to the wall. The Kurdish region earned about $630 million a month from direct oil sales in 2015, which still fell short of the $850 million or so it needed every month to pay its soldiers and civil servants, as well as foreign oil companies for the crude they’ve pumped. The two-week pipeline closure has now cost Erbil an additional $200 million — and the Kurdish losses will continue to grow until it comes back online. [Continue reading…]

Saudi Arabia is reeling from falling oil prices — and it could get much worse

The Washington Post reports: Stung by falling oil prices, Saudi Arabia has cut spending and subsidies as part of harsh austerity measures that threaten the lavish welfare programs underpinning its stability.

The oil-exporting giant’s economy has gone from producing windfalls to deficits, and Saudi rulers increasingly struggle to provide the cushy government jobs, expensive state handouts and tax-free living that have long bought them domestic obedience.

The pivot to austerity — which also has been imposed by neighboring Gulf Arab oil monarchies — risks triggering unrest in a Saudi society that is conservative and particularly resistant to change, analysts and diplomats warn.

The cutbacks are seen as necessary by King Salman’s son, defense minister and head of economic planning, Mohammed bin Salman. The 30-year-old prince has raised eyebrows for overseeing leadership shake-ups at home and two wars abroad. Advisers say he also intends to wean the country off its overwhelming dependence on oil sales and reform a bloated and opaque public sector. [Continue reading…]

Bill McKibben: It’s not just what Exxon did, it’s what it’s doing

The time scale should stagger you. Just imagine for a moment that what we humans do on this planet will last at least 10,000 more years, and no, I’m not talking about those statues on Easter Island or the pyramids or the Great Wall of China or the Empire State Building. I’m not talking about any of our monumental architectural-cum-artistic achievements. Ten thousand years from now all the monuments to our history may be forgotten ruins or simply obliterated, while what we’re doing at this very moment that’s truly ruinous may outlast us all. I’m thinking, of course, about the burning of fossil fuels and the sending of carbon dioxide (and other greenhouse gases) into the atmosphere. It’s becoming clearer by the month that, if not brought under control relatively quickly, this process will alter the global environment in ways that will affect humanity and everything else living on this planet for what, from a human point of view, is eternity.

In essence, there’s no backsies when it comes to climate change. Once you’ve begun the full-scale destabilization and melting of the Greenland ice sheet and of the vast ice sheets in the Antarctic, for instance, the future inundation of coastal areas, including many of humanity’s major cities, is a foregone conclusion somewhere down the line. In fact, a recent study, published in the journal Nature Climate Change by 22 climate scientists, suggests that when it comes to the melting of ice sheets and the rise of seas and oceans, we’re not just talking about how life will be changed on Planet Earth in 2100 or even 2200. We’re potentially talking about what it will be like in 12,200, an expanse of time twice as long as human history to date. So many thousands of years are hard even to fathom, but as the study points out, “A considerable fraction of the carbon emitted to date and in the next 100 years will remain in the atmosphere for tens to hundreds of thousands of years.” The essence of the report, as Chris Mooney wrote in the Washington Post, is this: “In 10,000 years, if we totally let it rip, the planet could ultimately be an astonishing 7 degrees Celsius warmer on average and feature seas 52 meters (170 feet) higher than they are now.”

Even far more modest temperature changes like the two degree Celsius rise discussed at the recent Paris meeting, where 196 nations signed onto a climate change agreement, would transform the face of the planet for thousands of years and result in the drowning of a range of iconic global cities “including New York, London, Rio de Janeiro, Cairo, Calcutta, Jakarta, and Shanghai.”

This, in other words, is what the hunt for yet more fossil fuels and more profits by the planet’s giant energy companies actually means — not tomorrow, but on a scale we don’t usually consider. This is why those who continue to insist on pursuing such a treasure hunt (for a few companies and their shareholders), despite knowing its grim future results, will truly be in the running with some of the monsters of our past to become the ultimate criminals of history. In this light, consider what Bill McKibben, TomDispatch regular, founder of 350.org, and author most recently of Oil and Honey: The Education of an Unlikely Activist, has to say about one of those companies, ExxonMobil, and its pivotal role in our warming world. Tom Engelhardt

Exxon’s never-ending big dig

Flooding the Earth with fossil fuels

By Bill McKibbenHere’s the story so far. We have the chief legal representatives of the eighth and 16th largest economies on Earth (California and New York) probing the biggest fossil fuel company on Earth (ExxonMobil), while both Democratic presidential candidates are demanding that the federal Department of Justice join the investigation of what may prove to be one of the biggest corporate scandals in American history. And that’s just the beginning. As bad as Exxon has been in the past, what it’s doing now — entirely legally — is helping push the planet over the edge and into the biggest crisis in the entire span of the human story.

Back in the fall, you might have heard something about how Exxon had covered up what it knew early on about climate change. Maybe you even thought to yourself: that doesn’t surprise me. But it should have. Even as someone who has spent his life engaged in the bottomless pit of greed that is global warming, the news and its meaning came as a shock: we could have avoided, it turns out, the last quarter century of pointless climate debate.

Assad preparing to handover Syria’s energy sector to Russia

The New Arab reports: The regime of Bashar al-Assad is reportedly seeking to rehabilitate and operate oil fields and power plants in areas controlled currently by the rebels and the Islamic State group respectively — areas that the regime forces began recapturing in northern and Western Syria backed by Russian airstrikes.

Measures are already in place by the Syrian regime to hand over the Syrian energy sector to Russian companies, led by a law on partnership between the private sector and foreign companies issued in early 2016.

Last month as well, Russian press reports said Bashar al-Assad, during a recent visit to Moscow, signed an agreement consisting of ten clauses purportedly giving Russia the right to freely operate in Syria, which cannot be revoked except by written agreement.

In the same vein, a recent report published by Russia’s RIA agency said Syria’s ambassador to Moscow, Riad Haddad, had met with the chairman of Russian gas company Gazprom Alexei Miller, and discussed giving Russian energy firms oil and gas concessions in Syria and other forms of cooperation. [Continue reading…]

How Scalia’s death might help our planet

Eric Holthaus writes: Supreme Court Justice Antonin Scalia’s death at a remote Texas ranch has triggered a political earthquake and instantly changes the outlook for a host of high-profile issues the court is currently considering. But perhaps none of these are as consequential as the fate of the planet itself. As Climate Central’s John Upton wrote, “in dying, Scalia may have done more to support global climate action than most people will do in their lifetimes.”

Scalia’s death comes just days after the Supreme Court issued an unprecedented stay that temporarily blocked the implementation of the Clean Power Plan, Obama’s centerpiece climate legislation. The Clean Power Plan isn’t perfect, but it was on pace to double the already accelerating rate of coal-fired power plant retirements by 2040. Last week’s surprising action by the Supreme Court — dubbed a “nightmare scenario” by the Hill — raised substantial fears among environmentalists that the court’s conservatives might eventually block the Clean Power Plan completely. At the very least, the stay buys some time for Republican hopefuls in this year’s presidential election; if one were to win, he could just cancel the executive order that launched the plan in the first place.

The stay is still in place, but the climate law experts I talked to say Scalia’s death greatly boosts the eventual survival chances of the Clean Power Plan. A 4-4 court would guarantee that the lower court ruling would stand—and the D.C. Circuit Court is expected to approve the plan. [Continue reading…]

New report shows oil getting dirtier, alternatives cleaner

Union of Concerned Scientists: American motorists are driving more efficient cars than ever, but when they fill up their tanks, the gas they pump into their cars and trucks is 30 percent dirtier to extract and refine than it was just ten years ago, according to an analysis released today by the Union of Concerned Scientists (UCS).

“Even as increased vehicle efficiency has cut global warming tailpipe emissions per mile, the search for tougher-to-extract sources of oil has increased the emissions that come from producing a gallon of gasoline by nearly a third over the past decade,” said Jeremy Martin, senior scientist for the UCS Clean Vehicles Program and lead author of the report.

The UCS report, “Fueling a Clean Transportation Future: Smart Fuel Choices for a Warming World,” is a comprehensive look at the global warming impact of how we fuel our cars and trucks. The report compares oil, biofuels and electricity, and finds a significant and growing gap between oil and other ways to fuel transportation. With more oil coming from depleted wells, tight oil and tar sands the climate impact of oil is rising—emissions from extracting and refining different sources of oil range by a factor of more than five. Electricity and biofuels, in contrast, are already cleaner than oil and have the potential to get even cleaner in years to come. [Continue reading…]

How Saudi Arabia’s grip on oil prices could bring Russia to its knees

By James Henderson, University of Oxford

When Saudi Arabia led an OPEC decision to end a restraint put on oil production in November 2014, it marked the beginning of a new era in oil economics. It has given us a tumbling oil price, prompted huge losses and job cuts at oil firms like BP and might yet give us economic and political drama in the heart of Moscow. To understand why, it’s worth drilling down to the start of the whole process, and the costs of getting oil out of the ground in the first place.

Historically, the OPEC cartel of oil-producing nations has been able to manage oil prices because of the lack of flexibility in global supply. The whole business of setting up wells, operating pipelines and building rigs entails large and long-term investments which makes producers slow to respond to price movements. And a small cut in OPEC supply can have a significant impact on the global oil price.

The advent of the US shale oil boom changed this dynamic. The industry has lower fixed costs but higher variable costs and is more like an industrial process than a major one-off investment. That makes it more responsive to price movements and more flexible in adjusting short-term output.

Overall though, shale is a relatively high cost source of oil, especially compared to Middle East production. As a result, when US shale threatened OPEC’s market share, the cartel allowed a position of global oversupply to develop. It was a simple trick: make oil prices fall to make shale unprofitable.

The staggering economic cost of air pollution

The Washington Post reports: Air pollution caused by energy production in the U.S. caused at least $131 billion in damages in the year 2011 alone, a new analysis concludes — but while the number sounds grim, it’s also a sign of improvement. In 2002, the damages totaled as high as $175 billion, and the decline in the past decade highlights the success of more stringent emissions regulations on the energy sector while also pointing out the need to continue cracking down.

“The bulk of the cost of emissions is the result of health impacts — so morbidity and particularly mortality,” said the paper’s lead author, Paulina Jaramillo, an assistant professor of engineering and public policy at Carnegie Mellon University. Using models, researchers can place a monetary value on the health effects caused by air pollution and come up with a “social cost” of the offending emissions — in other words, the monetary damages associated with emitting an additional ton (or other unit) of a given type of pollutant. This social cost can then be used to calculate the total monetary damages produced by a certain amount of emissions in a given time period.

The new analysis, just published in the journal Energy Policy, did just that. Using an up-to-date model and a set of data acquired from the Environmental Protection Agency on emissions from the energy sector, the researchers set about estimating the monetary damages caused by air pollution from energy production between 2002 and 2011. [Continue reading…]

Battered by war, Iraq now faces calamity from dropping oil prices

The New York Times reports: Iraqis seeking to withdraw money from banks are told there is not enough cash. Hospitals in Baghdad are falling back to the deprivation of the 1990s sanctions era, resterilizing, over and over, needles and other medical products meant for one-time use.

In the autonomous Kurdish region in the north, the economic crisis is even worse: government workers — and the pesh merga fighters who are battling the Islamic State — have not been paid in months. Already, there have been strikes and protests that have turned violent.

These scenes present a portrait of a country in the midst of an expensive war against the Islamic State that is now facing economic calamity brought on by the collapse in the price of oil, which accounts for more than 90 percent of the Iraqi government’s revenue.

Analysts and officials, though, say much tougher economic times are ahead, even as they insist the war will be largely unaffected because of help from foreign powers determined to defeat the Islamic State. The United States, for instance, recently extended new loans to Iraq to buy weapons, and other countries are stepping up with donations of arms and ammunition. [Continue reading…]

By 2030, renewables will be the world’s primary power source

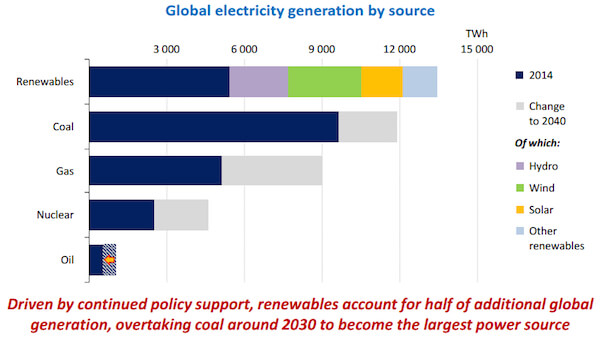

Climate Progress reports: In November, the International Energy Agency quietly dropped this bombshell projection: “Driven by continued policy support, renewables account for half of additional global generation, overtaking coal around 2030 to become the largest power source.”

In this post, I’ll dive deeper into this rapidly-approaching role reversal for coal and renewables. In Part Two, I’ll explain why the so-called “intermittency” problem for some renewables is basically solved and thus not a barrier to this reversal.

In releasing its World Energy Outlook 2015 last fall, the IEA published this chart of projected electricity generation in 2040: [Continue reading…]

SEC is criticized for lax enforcement of climate risk disclosure

The New York Times reports: As recently as 2011, shares in Peabody Energy, the world’s biggest private sector coal company, traded at the equivalent of $1,000. Today, they hover around $4 each. Over that time, investors who held the stock lost millions.

Peabody, like other coal companies, has been hammered as cheap natural gas erodes the demand for coal. But concerns about climate change are also an issue for the company as customers and investors turn away from fossil fuels.

Peabody saw this coming. Even as the company privately projected that coal demand would slump and prices would fall, it withheld this information from investors. Instead, Peabody said in filings with the Securities and Exchange Commission that it was not possible to know how changing attitudes toward climate change would affect its business.

Peabody’s double talk was revealed as part of a two-year investigation by the New York attorney general. In a settlement in November, Peabody agreed that it would disclose more about climate change risks in its regular filings with the S.E.C.

In theory, however, Peabody should have been making such disclosures all along. [Continue reading…]