The Washington Post reports: A brass band played, fighter jets streaked the clear blue sky and a red carpet adorned the airport tarmac on the day in May 2016 when Vladimir Putin came to Athens for a visit.

“Mr. President, welcome to Greece,” the Greek defense minister, Panos Kammenos, said in Russian as he smiled broadly and greeted a stone-faced Putin at the base of the stairs from the plane.

Kammenos, a pro-Russian Greek nationalist who bragged often of his insider Moscow connections, would receive a second key visitor that day, but with considerably less fanfare.

Not yet 30 years old, George Papadopoulos had been unknown in Greece — and everywhere else — only two months before.

But suddenly, just as Putin arrived, he was in Athens, quietly holding meetings across town and confiding in hushed tones that he was there on a sensitive mission on behalf of his boss, Donald Trump. [Continue reading…]

Category Archives: Greece

What democracies can learn from Greece’s failed populist experiment

Stathis Kalyvas writes: The abysmal incompetence of populists leads to the mistaken belief that their rule will end quickly. Although SYRIZA’s deafening failure looked certain to spell its political death, Tsipras engineered a snap election in September 2015, which he won easily. It was just too early for the stunned electorate to admit its mistake and turn back to the discredited mainstream parties. Through its complacency towards populist parties, the opposition placed itself at a marked disadvantage. By assuming that the populists’ inability to deliver on their promises would doom them, it ultimately helped them remain in power.

The lesson here is that voters often resist a return to mainstream parties once they have abandoned them. They also don’t like to be reminded that they were wrong to jump on the populist bandwagon in the first place. Rather, it is up to the non-populist parties, the fetid mainstream, to convince the electorate that they themselves have changed and are ready to offer credible solutions. In Greece, SYRIZA managed to reclaim power in September 2015, even after its policies failed, partly because it faced a tired, unreformed opposition. Only when the underdog Kyriakos Mitsotakis, a younger reformist, won New Democracy’s leadership, did this old, tired party gain political traction.

Paradoxically, this suggests that there’s nothing like a populist experiment to re-legitimize the mainstream. With their promises in tatters and their incompetence on full display, populist parties are eventually exposed. At this point, they face the choice to either go mainstream or disappear. Populism may well be a necessary, perhaps effective treatment for the belief that there are easy solutions to hard problems—for belief that one can escape reality. [Continue reading…]

Cyprus fears Russia could wreck reunification

Politico reports: As Cypriot leaders tussle with Greece, Turkey and the U.K. over the most delicate parts of an agreement to reunify the island, there’s a growing fear that Russia could spoil a deal.

That’s because the Kremlin has little to gain from the end of a four-decade split between Greek and Turkish Cypriots.

A peace deal would ease tensions between the European Union and Turkey, open the way to formal cooperation between the EU and NATO (blocked because Turkey and Cyprus don’t officially recognize each other), give Turkey a new source of natural gas imports and hand Brussels a diplomatic success story after a series of blows last year.

None of those advance Russia’s interests.

The fear on the Greek Cypriot side is that Moscow is using social and mass media, as well as ties to fringe nationalist political parties and the Greek Orthodox Church, to undermine the settlement talks. [Continue reading…]

Hellish Greek refugee camp becomes an inferno

The Daily Beast reports: The Moria refugee camp on the Greek island of Lesbos is a living hell even during the best of times. Last April, on the eve of Pope Francis’s historic visit, refugees complained to The Daily Beast through the barbed-wire fence that they had no hot water, no toilets and no information about how long they would have to stay. Many aid agencies long ago abandoned the camp to protest the way the refugees were being treated, which only served to make the conditions worse.

On Monday night, around the time diplomats in New York were signing a multi-national declaration to make life better for the world’s 21 million refugees, Moria’s hell became a literal inferno.

More than 4,000 refugees had to flee a fire that swept through the camp and raged late into the night, destroying more than a third of the shelters. The fire allegedly was set during a protest to mark a six-month anniversary of their detention in a camp that was built to house perhaps half the number of people there. Nine migrants and refugees were arrested on suspicion of starting the blaze.

Everything changed drastically on Lesbos and many other Greek islands last March when the European Union signed a deal with Turkey to trade illegal migrants or refugees for vetted ones. Since then, almost no one’s applications has been processed and the only people who have left the island are those deported back to Turkey. [Continue reading…]

Aid and attention dwindling, refugee crisis intensifies in Greece

The New York Times reports: As her young children played near heaps of garbage, picking through burned corn cobs and crushed plastic bottles to fashion new toys, Shiraz Madran, a 28-year-old mother of four, turned with tear-rimmed eyes to survey the desolate encampment that has become her home.

This year, her family fled Syria, only to get stuck at Greece’s northern border with Macedonia in Idomeni, a town that had been the gateway to northern Europe for more than one million migrants from the Middle East and Africa seeking a haven from conflict. After Europe sealed the border in February to curb the unceasing stream, the Greek authorities relocated many of those massed in Idomeni to a camp on this wind-beaten agricultural plain in northern Greece, with promises to process their asylum bids quickly.

But weeks have turned into months, and Mrs. Madran’s life has spiraled into a despondent daily routine of scrounging for food for her dust-covered children and begging the authorities for any news about their asylum application. “No one tells us anything — we have no idea what our future is going to be,” she said.

“If we knew it would be like this, we would not have left Syria,” she continued. “We die a thousand deaths here every day.” [Continue reading…]

Austerity continues spreading misery through Greece

Greece’s former finance minister, Yanis Varoufakis, writes: After last summer, when the clash between Greece’s Syriza government and the insolvent state’s creditors ended, the world’s media moved on. Greece’s rebellion against the austerity measures imposed on it was snuffed out in July 2015 when Prime Minister Alexis Tsipras folded.

Greece’s disappearance from the financial headlines since then has been seen as a sign that its economy has stabilized. Sadly, it has not.

Lest we forget, Greece had by 2015 already endured years of austerity. By 2013, more than a third of Greeks were living below the poverty line. By 2014, government wages and pensions had been cut 12 times in four years.

In comparative terms, by the proportion of national income diverted to reducing budget deficits, Greece had absorbed austerity measures almost nine times the magnitude of those imposed in Italy and about three times Portugal’s. The result? Between 2009 and 2014, Italy’s economy grew by a paltry 2 percent and Portugal’s contracted by 1 percent; in the same period, Greece’s national income dwindled by a catastrophic 26.6 percent — about the same as for America in the depths of the Great Depression. The result was a humanitarian disaster only a 21st-century John Steinbeck could adequately describe. [Continue reading…]

Syrian refugee wins appeal against forced return to Turkey

The Guardian reports: The EU-Turkey migration deal has been thrown further into chaos after an independent authority examining appeals claims in Greece ruled against sending a Syrian refugee back to Turkey, potentially creating a precedent for thousands of other similar cases.

In a landmark case, the appeals committee upheld the appeal of an asylum seeker who had been one of the first Syrians listed for deportation under the terms of the EU-Turkey deal.

In a document seen by the Guardian, a three-person appeals tribunal in Lesbos said Turkey would not give Syrian refugees the rights they were owed under international treaties and therefore overturned the applicant’s deportation order by a verdict of two to one. The case will now be re-assessed from scratch. [Continue reading…]

Greece: Refugee ‘hotspots’ unsafe, unsanitary

Human Rights Watch: Police are failing to protect people during frequent incidents of violence in closed centers on the Greek islands known as “hotspots,” Human Rights Watch said today. The centers were established for the reception, identification, and processing of asylum seekers and migrants. None of the three centers Human Rights Watch visited on Samos, Lesbos, and Chios in mid-May 2016, separate single women from unrelated adult men, and all three are unsanitary and severely overcrowded.

“In Europe’s version of refugee camps, women and children who fled war face daily violence and live in fear,” said Bill Frelick, refugee rights director at Human Rights Watch. “Lack of police protection, overcrowding, and unsanitary conditions create an atmosphere of chaos and insecurity in Greece’s razor wire-fenced island camps.”

On visits from May 9 to May 15, Human Rights Watch found all three facilities to be severely overcrowded, with significant shortages of basic shelter and filthy, unhygienic conditions. Long lines for poor quality food, mismanagement, and lack of information contribute to the chaotic and volatile atmosphere in the three hotspots, Human Rights Watch said. [Continue reading…]

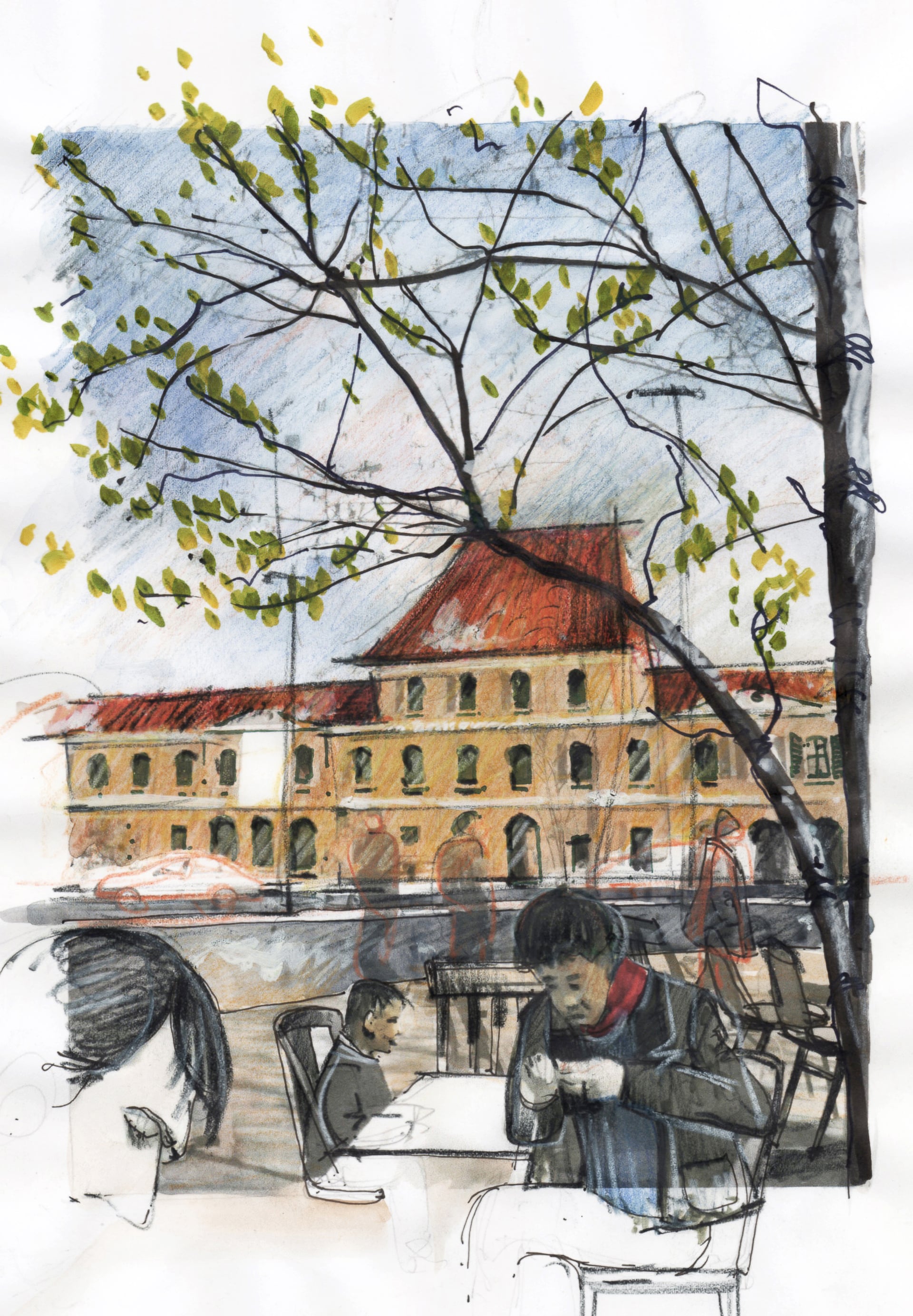

‘My soul is in Damascus’: Portraits of life on the refugee trail

In a moving series of sketches, Ghaith Abdul-Ahad captures grueling journeys blighted by poverty and exploitation: Last summer, the Turkish port city of Izmir became the springboard for hundreds of thousands of refugees hoping to reach Greece. They came looking for smugglers to take them to sea – and lifejackets to keep them alive. Every third shop on Fevzi Pasha Boulevard, a wide shopping street that led to the smugglers’ quarter, was happy to oblige.

“Original Yamaha,” shopkeepers would shout to passing refugees. “Come in and try one.” Some shoe-sellers and tailors put their usual stock in the basements, and started selling crudely made lifejackets instead. Smugglers block-booked the rooms of nearby hotels for their clients. Greece lay just across the Aegean.

In 2015, if there was a ground zero for Europe’s migration crisis, it was here, on the western Turkish coast. But a few months on, a deal has been struck between the EU and Ankara which should see most migrants arriving in Greece being deported back to Turkey, and the picture is very different. The hotels are empty. And the shopkeepers on Fevzi Pasha Boulevard are largely back to their original stock.

Sitting in a cafe in front of the train station, a thick orange scarf wrapped around his neck, a Syrian tailor watches people timidly as his son makes castles out of sugar cubes. A few weeks ago this cafe and the square teemed with smugglers conducting their illicit trade in the open, and refugees negotiating prices. Today, two Turkish police officers stand on a street corner to scare away smugglers and their clients. [Continue reading…]

Pope Francis takes 12 refugees back to Vatican after trip to Greece

The New York Times reports: Pope Francis made an emotional visit into the heart of Europe’s migrant crisis on Saturday and took 12 Muslim refugees from Syria, including six children, with him back to Rome aboard the papal plane.

The action punctuated the pope’s pleas for sympathy to the plight of the refugees just as European attitudes are hardening against them.

Those taken to Rome were three families — two from Damascus and one from the eastern city of Deir al-Zour — whose homes had been bombed in the Syrian war, the Vatican said in a statement as the pope departed the Greek island of Lesbos.

”The pope has desired to make a gesture of welcome regarding refugees,” the statement said, adding that the Vatican would care for the three families.

The announcement capped a brief trip by the pope to Greece that again placed the plight of migrants at the center of his papacy.

“We have come to call the attention of the world to this grave humanitarian crisis and to plead for its resolution,” Francis said during a lunchtime visit to the Moria refugee camp on Lesbos, where leaders of Eastern Orthodox Christian churches joined him.

“As people of faith, we wish to join our voices to speak out on your behalf,” Francis continued. “We hope that the world will heed these scenes of tragic and indeed desperate need, and respond in a way worthy of our common humanity.”

Francis’ first papal trip in 2013 was to the Italian island of Lampedusa, to call attention to the refugees who were arriving there from Libya — or drowning before they reached shore. During his February visit to Mexico, Francis prayed beneath a large cross erected in Ciudad Juárez, just footsteps from the Mexican border with the United States, and then celebrated Mass nearby, where he spoke about immigrants. [Continue reading…]

Endgame for the IMF-EU feud over Greece’s debt

Yanis Varoufakis writes: The feud between the International Monetary Fund (IMF) and the European side of Greece’s troika of creditors is old news. However, Wikileaks’ publication of a dialogue between key IMF players suggests that we are approaching something of a hazardous endgame.

Ever since the first Greek ‘bailout’ program was signed, in May 2010, the IMF has been violating its own “primary directive”: the obligation not to fund insolvent governments. As a result, the IMF’s leadership has been facing a revolt from its staff members who demand an exit strategy arguing that, if the EU continues to obstruct the debt relief necessary to restore the solvency of the Greek government, the IMF should leave the Greek program.

Five years on, this IMF-EU impasse continues, causing a one-third collapse of Greek GDP and fuelling hopelessness to a degree that has made real reform harder than ever.Back in February 2015, when I first met Poul Thomsen (the IMF’s European chief) in a Paris hotel, a fortnight after assuming Greece’s finance ministry, he appeared even keener than I was to press for a debt write off: “At a minimum”, he told me “€54 billion of Greece’s debt left over from the first ‘bailout’ should be written off immediately in exchange for serious reforms.”

This was music to my ears, and made me keen to discuss what he meant by “serious reforms”. It was a discussion that never got formally off the ground as Germany’s finance minister vetoed all discussion on debt relief, debt swaps (which were my compromise proposal), indeed any significant change to the failed program.

What new light does the leaked dialogue between Thomsen and Delia Velculescu (the IMF’s Greek mission chief) throw on this saga? [Continue reading…]

After WikiLeaks revelation, Greece asks IMF to clarify bailout plan

The New York Times reports: Greece called on the International Monetary Fund on Saturday to explain whether it was seeking to usher Athens toward bankruptcy ahead of a pivotal referendum in June on Britain’s membership in Europe. Greece’s comments came after I.M.F. officials raised questions in a private discussion published by WikiLeaks about what it would take to get Greece’s creditors to agree to debt relief.

The transcript, which captures what WikiLeaks said was a teleconference conversation in March between Poul Thomsen, the head of the I.M.F.’s European operations, and the I.M.F.’s Greek bailout monitor, underscored a widening rift between the I.M.F. and Greece’s European creditors that could jeopardize Greece’s new 86 billion euro bailout. It also exposed the fraught behind-the-scenes political machinations that have led to a deadlock on how to deal with a country still regarded as Europe’s weakest link.

The I.M.F. declined to comment on the WikiLeaks transcript, but said in a statement that Greece needed to be put “on a path of sustainable growth” supported by reforms and further debt relief. The document touched off a fresh political frenzy inside Prime Minister Alexis Tsipras’s government, which accused the I.M.F. of trying to “politically destabilize Europe.” [Continue reading…]

Amid clashes, Greece presses on with plan to deport refugees

The New York Times reports: Violent clashes erupted in Greek refugee camps among panicked migrants as Greece and the European Union pressed ahead on Friday with their intention to expel them from Europe and deport thousands back to Turkey, despite strong objections from rights groups and United Nations relief officials who say the plan is illegal and inhumane.

Hundreds of migrants broke out of an overcrowded detention center on the Greek island of Chios and began walking to the port to protest a European Union deal that went into effect in March, authorizing Greece to return them to Turkey if their applications for asylum in Europe were not accepted. The deportations officially begin on Monday.

Video clips in the Greek media showed migrants streaming away from the camp unhindered by the police, hours after a brawl broke out at the camp’s registration center. Several refugees were taken to a hospital after the riot police used stun grenades, and a help center run by Doctors Without Borders was destroyed, forcing the aid group to abandon its work. More than 1,500 migrants were being held at the center, designed for 1,200. Three people were also reported stabbed during a migrant riot on the island of Samos, where another detention facility operates. [Continue reading…]

Refugees lament as deal with Turkey closes door to Europe

The New York Times reports: Smoking cigarettes and huddling against the midnight chill, a group of Syrian men sat outside a mosque waiting for a smuggler’s call. It was their last chance, they said, to reach Europe.

It was late Friday, hours after they watched news reports from cafes and hotel lobbies that the Europe Union and Turkey had struck a deal that would send refugees from war-torn countries back to Turkey, from the shores of Greece. Time was running short: Officials said the deal would take effect Sunday.

“One hour ago,” said Milad Ameen, 19, when asked when he decided to set off for Europe. He had a life jacket, an inner tube and small bag containing his passport and school certificates he hoped would help him land a job in Europe.

As the men waited, they lamented a deal that they believe shuts the door on the last way out of their misery. “It’s for Turkey’s good, but not for the good of the Syrian people,” Mr. Ameen said.

A man standing next to him, who gave only his first name, Raafat, said he was from Aleppo, Syria. Raafat said he was demoralized that Europe no longer seemed to welcome Syrians. When he heard news of the pending deal, he rushed from Istanbul, where he had worked in a textile factory, to this coastal city. “We aren’t going to Europe to destroy Europe,” he said, explaining that he wished to assimilate and learn the language in whichever country would take him. “We are going in peace. [Continue reading…]

More than 44,000 refugees are already trapped in Greece, a number rising each day

The New York Times reports: Taha al-Ahmad’s family is sleeping in mud. His youngest daughter, age 1, lies beneath wet blankets, coughing inside their soggy tent. It has rained for days. Portable toilets are overflowing. Men burn firewood to stay warm. A drone circles overhead. Television trucks beam images of misery to the world.

It is primeval, and surreal, this squalid, improvised border camp of 12,000 refugees, a padlocked waiting room for entering the rest of Europe. Mr. Ahmad, barely two weeks out of Syria, does not understand why his family cannot cross the Macedonian border — roughly a football field away — and continue toward Germany. Hundreds of thousands of migrants passed through last year, but now Macedonia is closed. Europe’s door is slamming shut.

“I am in a very high degree of miserable,” Mr. Ahmad told me, speaking in a singsong English he learned in Syria, as our shoes sank into the muck.

“I ask my friends in Germany and Turkey: ‘What is happening? Tell us,’” he said. “We don’t know what is happening outside.”

To Mr. Ahmad, “outside” is the world of politics and policy beyond the wretchedness of the Idomeni camp. In Idomeni, refugees exist in a decrepit suspended animation. Disease spreads. Grandmothers sleep beside train tracks. Outside, specifically in Brussels, the leaders of the European Union, under public pressure to stop the migrant flow, will begin discussing the fate of refugees on Thursday, and a disputed plan to deport them to Turkey. [Continue reading…]

No way out: How Syrians are struggling to find an exit

Eleonora Vio reports: Over the last five years, close to 4.8 million Syrians have fled the conflict in their country by crossing into Jordan, Lebanon and Turkey. But as the war drags on, neighbours are sealing their borders. Forced from their homes by airstrikes and fighting on multiple fronts, the vast majority of Syrian asylum seekers now have no legal escape route.

Earlier this week, EU leaders reached a hard-won deal with Turkey aimed at ending a migration crisis that has been building since last year, and that in recent weeks has seen tens of thousands of migrants and refugees stranded in Greece. But the agreement turns a blind eye to the fact that even larger numbers of asylum seekers are stranded back in Syria, unable to reach safety.

Syrians hoping to apply for asylum in Europe first have to physically get there. EU member states closed their embassies in Syria at the start of the conflict, and even embassies and consulates in neighbouring countries have been reluctant to process visa and asylum applications.

When Syria’s war erupted in March 2011, it was initially relatively easy for most refugees to leave the country. Those without the means to fly poured out in waves of tens of thousands across land borders into Jordan, Lebanon, and Turkey. But one by one, these exits have been restricted or closed off entirely. [Continue reading…]

Outsourcing a humanitarian crisis to Turkey – is that the European thing to do?

By Marianna Fotaki, University of Warwick

European countries plan to send thousands of refugees back to Turkey in a deal aimed at preventing people from trying to reach the EU by sea.

In what is being described as a “one in, one out” deal, anyone washing up on the shores of Greece will be sent back to Turkey, with one person being transferred from a Turkish refugee camp in their place.

But the deal, which is yet to be finalised, is flawed from the outset. Denying refugees the right to apply for asylum as they reach the EU is against international humanitarian law. And refusing protection to unarmed people fleeing war and persecution by sending them back to Turkey, a country under threat of a civil war, is unconscionable.

European Union leaders must be both desperate and clueless to pursue this. If the goal is to save the European Union from implosion, the question is on what terms will its unity be maintained?

Refugee crisis magnified by European divisions

Der Spiegel reports: A rickety gate of galvanized wire is all that separates desperation from hope. The gate is part of the fence erected in the farming village of Idomeni on the border between Greece and Macedonia. At this moment, some 12,000 people are waiting for it to be opened.

It’s the gateway to Europe and the gateway to Germany.

A woman in boots and a blue uniform stands guard in front of the gate. Her name is Foteini Gagaridou and she is an official with the Greek border police — and she looks exhausted. All it would take for her to open the border would be to pull a thin metal pin out of the latch, but she’s not allowed to.

If it were up to her, she says, she would let every single one of these people pass through, just as they were able to do just a few weeks earlier — across the border to Macedonia and on through Serbia, Croatia and Slovenia to Austria, where they could continue their journey to Germany on what is known as the Balkan Route. It’s the same path chosen by hundreds of thousands of refugees last year, but the Balkan Route is now closed. It ends at Gagaridou’s wire gate.

This is where Fortress Europe begins, secured with razor wire and defended with tear gas. Desperate scenes played out here on Monday, reminiscent of those witnessed in Hungary back in September. A group of young men used a steel beam as a battering ram to break down the gate. Rocks flew through the air as the gate flew off its hinges, prompting the volleying of tear gas cartridges and stun grenades from the Macedonian side. Men could be seen running and children screaming. One woman lay on the ground with her daughter, crying.

This frontier has become Europe’s new southern border, with Greece serving as Europe’s waiting room — and the possible setting for a humanitarian disaster. Around 32,000 migrants are currently stranded in the country, a number that the Greek Interior Ministry says could quickly swell to 70,000. The aid organization Doctors Without Borders is even expecting 200,000 refugees. Greece’s reception camps are already full, and the highly indebted country is stretched well beyond its capacity.

The decision as to whether and how many refugees will be able to cross the border isn’t one for border guard Gagaridou to make. Rather, it will be taken by the Macedonian government. Macedonia, for its part, is pointing fingers at countries further to the north, noting it is they who have tightened their borders, especially Austria, which created a chain reaction of border closures last week. The countries apparently felt they could wait no longer for the broader European solution German Chancellor Angela Merkel has promised will result from a special EU summit scheduled for March 7.

Merkel wants to see Turkey stem the flow of refugees and put a stop to the exodus to Europe. European leaders agreed on Feb. 18 that this plan remains the “priority.” But Austria and the Balkan states nevertheless moved ahead and closed their borders.

Idomeni has become a symbol of the current political chaos in Europe and the crumbling of a joint European refugee policy. The town is emblematic of the new Europe of fences. It is here that German Chancellor Angela Merkel’s open border policies have met their end. Under Austria’s leadership, the Balkan Route has been closed in the precise move Berlin had hoped to avoid.

Merkel has begun warning of the EU’s disintegration “into small states” that will be unable to compete in a globalized world, as well as of the possibility that border controls might soon be reintroduced all across Europe.

Were Europe in agreement, it would be unproblematic to accommodate 2-3 million refugees, given the Continent’s population of a half billion people. From such a perspective, the current spat actually seems somewhat ridiculous. But in the run up to next week’s EU summit, Europe is gripped by strife. Europe’s greatest achievement, the opening of its borders through the Schengen agreement, is at stake, and the increasingly toxic atmosphere between countries has reached alarming dimensions. [Continue reading…]