Michael Powell writes: The Bank of America lawyer laid down a patented rhetorical move heard in courts across America. Your Honor, this Orange County, N.Y., homeowner — a New York City police officer — didn’t make enough money to qualify for a mortgage modification. He didn’t send us the right documents.

He didn’t, he didn’t, he didn’t, and so we should be allowed to foreclose.

Justice Catherine M. Bartlett of New York State Supreme Court cut off the lawyer. You, she said, are telling me lies.

“Bank of America got a bailout, and this is an outrage, how this man has been treated,” she said. “Hard-working, middle-class Americans are trying to make it, trying to refinance with your bank.”

Either bank officials show up in person, the justice said, or I’m going to order them “here in handcuffs.”

Rage has acquired a cleansing power. Patience as a virtue is a hard sell at the burnt end of a four-year economic collapse. Zuccotti Park shakes, rattles and rolls; television yakkers chat about inequality; and the federal judge Jed Rakoff all but heckled the Securities and Exchange Commission last week for going easy on Citigroup misbehavior.

Then there is Eric T. Schneiderman, New York’s attorney general, caught in Month 5 of a face-off with the White House. President Obama dearly wants to seal a deal in which the nation’s largest banks toss over a few bales of cash — $20 billion to help with foreclosure relief — and the state attorneys general agree not to pursue sprawling and explosive legal cases against the banks.

Mr. Schneiderman and Attorney General Beau Biden of Delaware, joined by a few others, say no. Banks, they say, should disgorge more documents, testify more precisely and prove more completely that they own millions of mortgage notes. These rebel attorneys general want the banks to hand over more than $200 billion, which would enable the government to write down tens of millions of mortgages.

But in the end, their argument is elemental: Wouldn’t the nation benefit from knowing the truth about the behavior of banks and bankers?

Category Archives: corruption

The new progressive movement

Jeffrey Sachs writes: Twice before in American history, powerful corporate interests dominated Washington and brought America to a state of unacceptable inequality, instability and corruption. Both times a social and political movement arose to restore democracy and shared prosperity.

The first age of inequality was the Gilded Age at the end of the 19th century, an era quite like today, when both political parties served the interests of the corporate robber barons. The progressive movement arose after the financial crisis of 1893. In the following decades Theodore Roosevelt and Woodrow Wilson came to power, and the movement pushed through a remarkable era of reform: trust busting, federal income taxation, fair labor standards, the direct election of senators and women’s suffrage.

The second gilded age was the Roaring Twenties. The pro-business administrations of Harding, Coolidge and Hoover once again opened up the floodgates of corruption and financial excess, this time culminating in the Great Depression. And once again the pendulum swung. F.D.R.’s New Deal marked the start of several decades of reduced income inequality, strong trade unions, steep top tax rates and strict financial regulation. After 1981, Reagan began to dismantle each of these core features of the New Deal.

Following our recent financial calamity, a third progressive era is likely to be in the making. This one should aim for three things. The first is a revival of crucial public services, especially education, training, public investment and environmental protection. The second is the end of a climate of impunity that encouraged nearly every Wall Street firm to commit financial fraud. The third is to re-establish the supremacy of people votes over dollar votes in Washington.

None of this will be easy. Vested interests are deeply entrenched, even as Wall Street titans are jailed and their firms pay megafines for fraud. The progressive era took 20 years to correct abuses of the Gilded Age. The New Deal struggled for a decade to overcome the Great Depression, and the expansion of economic justice lasted through the 1960s. The new wave of reform is but a few months old.

The young people in Zuccotti Park and more than 1,000 cities have started America on a path to renewal. The movement, still in its first days, will have to expand in several strategic ways. Activists are needed among shareholders, consumers and students to hold corporations and politicians to account. Shareholders, for example, should pressure companies to get out of politics. Consumers should take their money and purchasing power away from companies that confuse business and political power. The whole range of other actions — shareholder and consumer activism, policy formulation, and running of candidates — will not happen in the park.

The new movement also needs to build a public policy platform. The American people have it absolutely right on the three main points of a new agenda. To put it simply: tax the rich, end the wars and restore honest and effective government for all.

Finally, the new progressive era will need a fresh and gutsy generation of candidates to seek election victories not through wealthy campaign financiers but through free social media. A new generation of politicians will prove that they can win on YouTube, Twitter, Facebook and blog sites, rather than with corporate-financed TV ads. By lowering the cost of political campaigning, the free social media can liberate Washington from the current state of endemic corruption. And the candidates that turn down large campaign checks, political action committees, Super PACs and bundlers will be well positioned to call out their opponents who are on the corporate take.

Those who think that the cold weather will end the protests should think again. A new generation of leaders is just getting started. The new progressive age has begun.

Finally, a judge stands up to Wall Street

Matt Taibbi writes: Federal judge Jed Rakoff, a former prosecutor with the U.S. Attorney’s office here in New York, is fast becoming a sort of legal hero of our time. He showed that again yesterday when he shat all over the SEC’s latest dirty settlement with serial fraud offender Citigroup, refusing to let the captured regulatory agency sweep yet another case of high-level criminal malfeasance under the rug.

The SEC had brought an action against Citigroup for misleading investors about the way a certain package of mortgage-backed assets had been chosen. The case is very similar to the notorious Abacus case involving Goldman Sachs, in which Goldman allowed short-selling billionaire John Paulson (who was betting against the package) to pick the assets, then told a pair of European banks that the “designed to fail” package they were buying had been put together independently.

This case was similar, but worse. Here, Citi similarly told investors a package of mortgages had been chosen independently, when in fact Citi itself had chosen the stuff and was betting against the whole pile.

This whole transaction actually combined a number of Goldman-style misdeeds, since the bank both lied to investors and also bet against its own product and its own customers. In the deal, Citi made a $160 million profit, while its customers lost $700 million.

Goldman, in the Abacus case, got fined $550 million. In this worse case, the SEC was trying to settle with Citi for just $285 million. Judge Rakoff balked at the settlement and particularly balked at the SEC’s decision to allow Citi off without any admission of wrongdoing. He also mocked the SEC’s decision to describe the crime as “negligence” instead of intentional fraud, taking the entirely rational position that there’s no way a bank making $160 million ripping off its customers can conceivably be described as an accident.

“Why should the court impose a judgment in a case in which the SEC alleges a serious securities fraud but the defendant neither admits nor denies wrongdoing?” And this: “How can a securities fraud of this nature and magnitude be the result simply of negligence?”

Rakoff of course is right – the settlement is nuts. If you take Citi’s $160 million profit on the deal into consideration, what we’re talking about then is a $125 million fine for causing $700 million in damages. That, and no admission of wrongdoing.

Just imagine a mugger who steals $70 from some lady’s wallet being sentenced to walk free after paying back twelve bucks. Magritte himself could not devise a more surreal take on criminal justice.

Congress for sale

Bill Moyers: ‘They are occupying Wall Street because Wall Street is occupying America

Bill Moyers says: The great American experience in creating a different future together — this “voluntary union for the common good” – has been flummoxed by a growing sense of political impotence — what the historian Lawrence Goodwyn has described as a mass resignation of people who believe “the dogma of democracy” on a superficial public level but who no longer believe it privately. There has been, he writes, a decline in what people think they have a political right to aspire to — a decline of individual self-respect on the part of millions of people.

You can understand why that is. We hold elections, knowing they are unlikely to produce the policies favored by a majority of Americans. We speak, we write, we advocate — and those in power, Democrats and Republicans, liberals and conservatives, turn deaf ears and blind eyes to our deepest aspirations. We petition, we plead, we even pray — yet the Earth that is our commons and should be passed on in good condition to coming generations, continues to be despoiled. We invoke the strain in our national DNA that attests to “life, liberty, and the pursuit of happiness” as the produce of political equality — yet private wealth multiplies even as public goods are beggared.

And the property qualifications for federal office that the framers of the Constitution expressly feared as an unseemly “veneration for wealth” are now openly in force and the common denominator of public office, including for our judges, is a common deference to cash.

So if belief in the “the dogma of democracy” seems only skin deep, there are reasons for it.

During the great prairie revolt that swept the plains a century after the Constitution was ratified, the populist orator Mary Elizabeth Lease explained “Wall Street owns the country. Our laws are the output of a system which clothes rascals in robes and honesty in rags. The parties lie to us, and the political speakers mislead us,” because, she said, “money rules.”

That was 1890. And those agrarian populists were boiling over with anger that the corporations, banks and government were conniving to deprive everyday people of their livelihood. They should see us now.

John Boehner calls on the bankers, holds out his cup, and offers them total obeisance from the House majority if only they will fill it. That’s now the norm, and they get away with it.

Barack Obama criticizes bankers as fat cats, then invites them to dine at a pricy New York restaurant where the tasting menu runs to $195 a person. And that’s the norm. And they get away with it.

As we speak, the president has raised more money from banks, hedge funds, and private equity managers than any Republican candidate, including Mitt Romney. Let’s name it for what it is: democratic deviancy defined downward. Politics today — and there are honorable men and women in it — but politics today is little more than money laundering and the trafficking of power and policy, fewer than six degrees of separation from the spirit and tactics of Tony Soprano.

Why New York’s Zuccotti Park is occupied is no mystery — reporters keep scratching their heads and asking, “Why are you here?” But it’s as clear as the crash of 2008: they are occupying Wall Street because Wall Street has occupied America.

Activate: How to mobilise a million

Obama’s gift to the Koch brothers and curse to the planet

Jamie Henn, Co-founder and Communications Director of 350.org, writes: Here’s a unique political strategy for you: in the lead up to a crucial election, as anti-corporate sentiment is sweeping the nation, consider giving a huge handout to a major corporation that happens to be your biggest political enemy and is already spending hundreds of millions to defeat you and your agenda.

If that seems too crazy to believe, welcome to the Obama 2012 campaign.

Right now, President Obama is faced with the most crucial environmental decisions he is going to face before the 2012 election: whether or not to approve the permit for the controversial Keystone XL pipeline, a 1,700 mile fuse to the largest carbon bomb on the continent, the Canadian tar sands.

The Keystone XL isn’t just an XL environmental disaster — the nation’s top climate scientists say that fully exploiting the tar sands could mean “essentially game over” for the climate — it also happens to be an XL sized handout to Big Oil and, you guessed it, the Brothers Koch. You want fries with that?

Earlier this year, when Representative Henry Waxman (D-Calif.) attempted to investigate whether or not the Koch Brothers stood to gain from the pipeline, the chairman of the House Committee on Energy and Commerce, Fred Upton (R-Mich.) called the idea an “outrageous accusation” and “blatant political sideshow.” Is it even necessary to mention that reports show Koch and its employees gave $279,500 to 22 of the energy committee’s 31 Republicans and $32,000 to five Democrats?

As you might expect, Upton was completely wrong. Reporters at InsideClimateNews and elsewhere proved that the Koch’s stand to make a fortune with the construction of the pipeline. The brothers already control close to 25 percent of the tar sands crude that is imported into the United State and own mining companies, oil terminals, and refineries all along the pipeline route. You can bet that the champagne will be flowing in Koch HQ when toxic tar sands crude starts moving down the pipe.

Which brings us back to Obama. It’s not too late for the president to intervene and stop the Koch Brothers from pocketing another profit at the expense of the American people. Because it crosses an international border, in order for the Keystone XL pipeline to be built the Obama administration must grant it a “presidential permit” that states that the construction project is in the national interest of the United States.

President Obama can deny the permit, right now, and shut down this flow of cash to the Kochs. In doing so, he’ll show that our national interest isn’t always determined by the 1%, in this case a few big oil companies and the Koch Brothers, but by the 99% of us who have to pay the price for their greed.

Denying the permit will also send a jolt of electricity through President Obama’s base, the millions of us who went out and volunteered and donated to the campaign because we believed in a candidate who said that it was time to “end the tyranny of oil.” In fact, this November 6, thousands of us former believers will be descending on Washington, DC to surround the White House with people carrying placards with the President’s own words in an attempt to resuscitate the 2008 Obama who seemed capable of standing up to folks like the Kochs. You can join here.

I can’t say that I’m privy to what the Obama 2012 campaign will advise the president to do when it comes to the pipeline. But if I was sitting in Chicago watching the Koch Brothers assembled their army of lobbyists across the nation, I’d be thinking that XL handout wasn’t such a good idea.

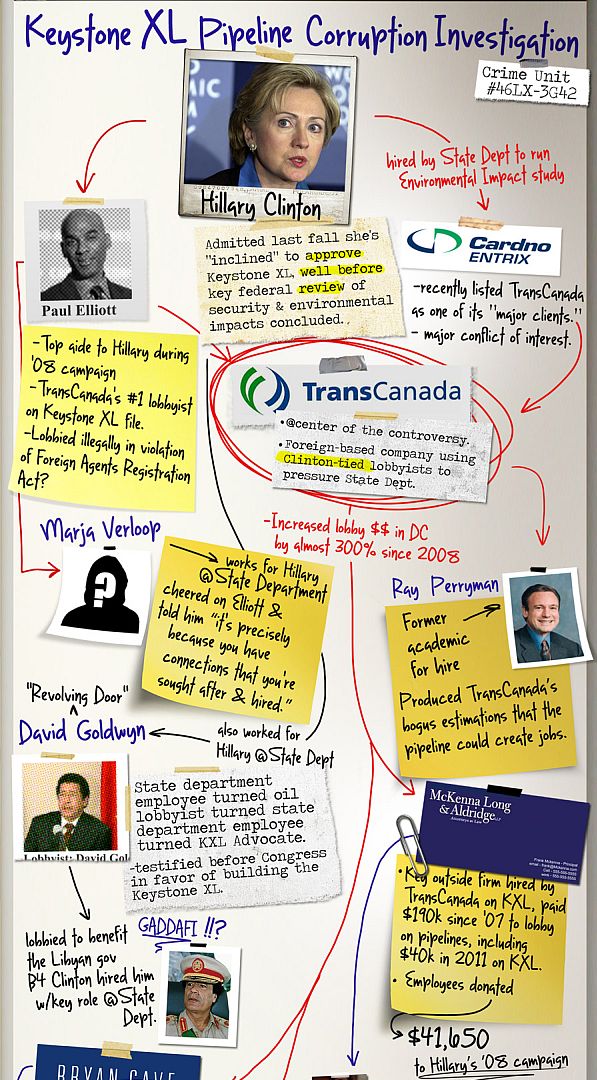

The Keystone XL pipeline network of corruption revealed through an investigation by DeSmogBlog, Oil Change International, The Other 98% and Friends of the Earth (click on the image below to view the complete network):

Time for the U.S. to stop bankrolling Israel’s defense

Walter Pincus, in a column for the Washington Post, writes: As the country reviews its spending on defense and foreign assistance, it is time to examine the funding the United States provides to Israel.

Let me put it another way: Nine days ago, the Israeli cabinet reacted to months of demonstrations against the high cost of living there and agreed to raise taxes on corporations and people with high incomes ($130,000 a year). It also approved cutting more than $850 million, or about 5 percent, from its roughly $16 billion defense budget in each of the next two years.

If Israel can reduce its defense spending because of its domestic economic problems, shouldn’t the United States — which must cut military costs because of its major budget deficit — consider reducing its aid to Israel?

First, a review of what the American taxpayer provides to Israel.

In late March 2003, just days after the invasion of Iraq, President George W. Bush requested the approval of $4.7 billion in military assistance for more than 20 countries that had contributed to the conflict or the broader fight against terrorism. Israel, Jordan, Egypt, Afghanistan, Pakistan and Turkey were on that list.

A major share of the money, $1 billion, went to Israel, “on top of the $2.7 billion regular fiscal year 2003 assistance and $9 billion in economic loans guaranteed by the U.S. government over the next three years,” according to a 2003 study by the Congressional Research Service (CRS).

Then in 2007, the Bush administration worked out an agreement to raise the annual military aid grant, which had grown to $2.5 billion, incrementally over the next 10 years. This year, it has reached just over $3 billion. That is almost half of all such military assistance that Washington gives out each year and represents about 18 percent of the Israeli defense budget.

In addition, the military funding for Israel is handled differently than it is for other countries. Israel’s $3 billion is put almost immediately into an interest-bearing account with the Federal Reserve Bank. The interest, collected by Israel on its military aid balance, is used to pay down debt from earlier Israeli non-guaranteed loans from the United States.

Another unique aspect of the assistance package is that about 25 percent of it can be used to buy arms from Israeli companies. No other country has that privilege, according to a September 2010 CRS report.

The U.S. purchases subsidize the Israeli arms business, but Washington maintains a veto over sales of Israeli weapons that may contain U.S. technology.

Look for a minute at the bizarre formula that has become an element of U.S.-Israel military aid, the so-called qualitative military edge (QME). Enshrined in congressional legislation, it requires certification that any proposed arms sale to any other country in the Middle East “will not adversely affect Israel’s qualitative military edge over military threats to Israel.”

In 2009 meetings with defense officials in Israel, Undersecretary of State Ellen Tauscher “reiterated the United States’ strong commitment” to the formula and “expressed appreciation” for Israel’s willingness to work with newly created “QME working groups,” according to a cable of her meetings that was released by WikiLeaks.

The formula has an obvious problem. Because some neighboring countries, such as Saudi Arabia and Egypt, are U.S. allies but also considered threats by Israel, arms provided to them automatically mean that better weapons must go to Israel. The result is a U.S.-generated arms race.

MJ Rosenberg writes: Aid to Israel is virtually the only program, domestic or foreign, that is exempt from every budget cutting proposal pending in Congress. No matter that our own military is facing major cuts along with Medicare, cancer research and hundreds of other programs, Israel’s friends in Congress in both parties make sure that aid to Israel is protected at current levels.

Back when I was a Congressional staffer, I was part of the process by which aid to Israel was secured. Every member of the Congressional Appropriations Committees sent a “wish list” to the chairman of the committee telling him or her which programs he wanted funded and by what amounts. Each letter reflected the particular interest of a particular Representative or Senator and of his own district or state.

There was always one exception: aid to Israel, which apparently is a local issue for every legislator. The American Israel Public Affairs Committee (AIPAC) would provide the list of Israel’s aid requirements for the coming year and, with few if any exceptions, every letter would include the AIPAC language. Not a punctuation mark would be changed.

At the end of the process, the AIPAC wish list would become law of the land. (Woe to any Member of Congress who dared to resist the AIPAC juggernaut).

That is how it has been for decades and not even the current economic crisis is likely to change it. On this issue, Congress is hopeless and will remain so as long as its members rely so heavily on campaign contributions (PAC or individual) delivered by AIPAC.

JTA reports: Mitt Romney said he would increase defense assistance to Israel, raise the U.S. military profile near Iran and recognize Israel as a Jewish state.

Stop snitchin: Fox News and Wall Street banks hustle to kill new whistleblower protections

Lee Fang reports: A few years go, a media firestorm erupted over the urban “Stop Snitchin” campaign promoted by gangs and a few hip hop icons. Stop Snitchin refers to the effort to intimidate informants to prevent them from cooperating with police about gang violence or drug trafficking schemes. Rapper Cam’ron received heavy scrutiny for endorsing the trend during an interview on the issue for CBS’s 60 Minutes.

A new Stop Snitchin campaign to deter would-be informants, in this case against people speaking up against crimes on Wall Street, is quietly taking shape, this time far from the media’s eye.

Financial experts and academics agree that strong whistleblower regulations could have prevented the Bernie Madoff Ponzi scheme and indeed much of the financial crisis if employees at firms engaged in fraudulent activity had spoken up early or had reported complex crimes to the appropriate authorities. Employees at firms at the center for the financial crisis, including troubled lender Countrywide, have cited intimidation and other illicit tactics as the reason few people spoke up as whistleblowers. Since the old whistleblower laws provided for weak legal protections for informants and relatively rare rewards, the Dodd-Frank financial reform law passed last year revamped the system with new rights for informants blowing the whistle on financial crimes.

Bank lobbyists and Fox News, however, have made such protections enemy number one.

Koch brothers flout law getting richer with secret Iran sales

Bloomberg reports:

In May 2008, a unit of Koch Industries Inc., one of the world’s largest privately held companies, sent Ludmila Egorova-Farines, its newly hired compliance officer and ethics manager, to investigate the management of a subsidiary in Arles in southern France. In less than a week, she discovered that the company had paid bribes to win contracts.

“I uncovered the practices within a few days,” Egorova- Farines says. “They were not hidden at all.”

She immediately notified her supervisors in the U.S. A week later, Wichita, Kansas-based Koch Industries dispatched an investigative team to look into her findings, Bloomberg Markets magazine reports in its November issue.

By September of that year, the researchers had found evidence of improper payments to secure contracts in six countries dating back to 2002, authorized by the business director of the company’s Koch-Glitsch affiliate in France.

“Those activities constitute violations of criminal law,” Koch Industries wrote in a Dec. 8, 2008, letter giving details of its findings. The letter was made public in a civil court ruling in France in September 2010; the document has never before been reported by the media.

Egorova-Farines wasn’t rewarded for bringing the illicit payments to the company’s attention. Her superiors removed her from the inquiry in August 2008 and fired her in June 2009, calling her incompetent, even after Koch’s investigators substantiated her findings. She sued Koch-Glitsch in France for wrongful termination.

Koch-Glitsch is part of a global empire run by billionaire brothers Charles and David Koch, who have taken a small oil company they inherited from their father, Fred, after his death in 1967, and built it into a chemical, textile, trading and refining conglomerate spanning more than 50 countries.

Koch Industries is obsessed with secrecy, to the point that it discloses only an approximation of its annual revenue — $100 billion a year — and says nothing about its profits.

Tony Blair’s nexus of Middle East conflicts of interest

“It’s easy enough to see what Tony Blair has got out of the Middle East peace process: introductions to Arab rulers; a nice address in Jerusalem; a continued presence on the world stage. What’s more difficult to see is what the Middle East peace process has got out of Tony Blair.”

The Associated Press reports:

Since stepping down as Britain’s prime minister, Tony Blair has built up a formidable work portfolio: He’s an international peacemaker, a consultant for investment bank JP Morgan, a pricey public speaker and a philanthropist.

He’s so many things to so many people that it’s starting to cause him trouble — with human rights groups, the Palestinian Authority, and even current British Prime Minister David Cameron, who described Blair’s deals with Moammar Gadhafi’s regime as “dodgy deals in the desert.”

Rights workers who have tried to track his activities find it’s sometimes unclear which job he is doing — or who is paying him to do it. Crucially, when he’s in the Arab world as the Middle East Quartet’s peace envoy some of the very parties he’s meant to be negotiating with aren’t sure whose interests he’s representing.

“The problem is a lack of transparency over how Tony Blair has organized his business affairs,” said Robert Palmer, a campaigner at pressure group Global Witness. “If former leaders are appearing on a public stage, it’s important that they do all they can to make sure they are seen to be open and clear over what they are doing.”

Blair’s effectiveness and impartiality in the Middle East are under attack from the Palestinian Authority, which accuses him of acting “like an Israeli diplomat” after he refused to support their decision to sidestep negotiations and to ask the Security Council for admission to the United Nations as a state. At the same time, the collapse of Moammar Gadhafi’s regime in Libya has led to the discovery of documents that show that Blair maintained ties to the Libyan leader even after he left office.

Rebelling against the globalization of corruption

The New York Times reports:

Hundreds of thousands of disillusioned Indians cheer a rural activist on a hunger strike. Israel reels before the largest street demonstrations in its history. Enraged young people in Spain and Greece take over public squares across their countries.

Their complaints range from corruption to lack of affordable housing and joblessness, common grievances the world over. But from South Asia to the heartland of Europe and now even to Wall Street, these protesters share something else: wariness, even contempt, toward traditional politicians and the democratic political process they preside over.

They are taking to the streets, in part, because they have little faith in the ballot box.

“Our parents are grateful because they’re voting,” said Marta Solanas, 27, referring to older Spaniards’ decades spent under the Franco dictatorship. “We’re the first generation to say that voting is worthless.”

Economics have been one driving force, with growing income inequality, high unemployment and recession-driven cuts in social spending breeding widespread malaise. Alienation runs especially deep in Europe, with boycotts and strikes that, in London and Athens, erupted into violence.

But even in India and Israel, where growth remains robust, protesters say they so distrust their country’s political class and its pandering to established interest groups that they feel only an assault on the system itself can bring about real change.

Young Israeli organizers repeatedly turned out gigantic crowds insisting that their political leaders, regardless of party, had been so thoroughly captured by security concerns, ultra-Orthodox groups and other special interests that they could no longer respond to the country’s middle class.

In the world’s largest democracy, Anna Hazare, an activist, starved himself publicly for 12 days until the Indian Parliament capitulated to some of his central demands on a proposed anticorruption measure to hold public officials accountable. “We elect the people’s representatives so they can solve our problems,” said Sarita Singh, 25, among the thousands who gathered each day at Ramlila Maidan, where monsoon rains turned the grounds to mud but protesters waved Indian flags and sang patriotic songs.

“But that is not actually happening. Corruption is ruling our country.”

Increasingly, citizens of all ages, but particularly the young, are rejecting conventional structures like parties and trade unions in favor of a less hierarchical, more participatory system modeled in many ways on the culture of the Web.

In that sense, the protest movements in democracies are not altogether unlike those that have rocked authoritarian governments this year, toppling longtime leaders in Tunisia, Egypt and Libya.

The terrorism industry that hijacked America

John Tirman writes:

The anniversary of the 9/11 attacks has, predictably, loosed a torrent of sentimental accounts of that terrible day ten years ago.

They recall the shock and horror at these unprecedented events, the courage of the firefighters, the sadness of the victims’ families, and the traumatic impact to the nation. All of this is understandable. What is missing in this retelling, however, are the consequences for America—the enormous cost of “homeland security”—and for the populations of Iraq and Afghanistan who have borne the brunt of America’s vengeance.

For those populations, the penalty is severe. Both countries are still buffeted by chronic warfare that was spurred by U.S. interventions. However one reckons the justifications for the invasions and occupations, the wreckage is undeniable. In Iraq, the number of people killed since the 2003 invasion is well into in the hundreds of thousands, and some four million or more Iraqis have been displaced from their homes. In Afghanistan, the violence has taken a lower toll, but is still in the tens of thousands with no end in sight. For both countries, the living conditions remain difficult—health, clean water, education, livelihoods, and social peace far from adequate.

Those grisly outcomes are occasionally acknowledged in American political discourse, although the costs of war are almost always calibrated in American lives lost and money squandered. The “blood and treasure” calculus rarely mentions the local populations, of course, but even the cost to Americans is sobering: 6,000 lives, tens of thousands maimed, and $4 trillion expended. That $4 trillion does not include vastly expanded Pentagon spending in addition to the wars, spending that has gotten a free pass in the last decade. But another cost is scarcely discussed: the enormous and expanding homeland security juggernaut.

The post-9/11 atmosphere spawned a government and societal response that uses fear and suspicion as a guiding belief system. The government has spent colossal amounts of money and has spurred the private sector to do likewise to check every person entering a skyscraper, scrutinize trillions of emails and phone messages, and expand the “security envelope” of the United States around the world. In dollars, that translates into something like $1 trillion spent by the federal government and probably a similar amount by businesses, educational institutions, and local governments. (Tellingly, there is no estimate of these non-federal costs.) Homeland security, in fact, feeds on the anxieties spawned by 9/11 and nurtured by politicians, in part because it supports pork-barrel politics in the same way that anti-communist fervor fueled excessive military spending and domestic surveillance during the long rivalry with the Soviet Union.

Counter-terrorism Inc. — How the US government funds America’s booming security industry

The Los Angeles Times reports:

On the edge of the Nebraska sand hills is Lake McConaughy, a 22-mile-long reservoir that in summer becomes a magnet for Winnebagos, fishermen and kite sailors. But officials here in Keith County, population 8,370, imagined this scene: an Al Qaeda sleeper cell hitching explosives onto a ski boat and plowing into the dam at the head of the lake.

The federal Department of Homeland Security gave the county $42,000 to buy state-of-the-art dive gear, including full-face masks, underwater lights and radios, and a Zodiac boat with side-scan sonar capable of mapping wide areas of the lake floor.

Up on the lonely prairie, Cherry County, population 6,148, got thousands of federal dollars for cattle nose leads, halters and electric prods — in case terrorists decided to mount biological warfare against cows.

In the Los Angeles suburb of Glendale, where police fear militants might be eyeing DreamWorks Animation or the Disney creative campus, a $205,000 Homeland Security grant bought a 9-ton BearCat armored vehicle, complete with turret. More than 300 BearCats — many acquired with federal money — are now deployed by police across the country; the arrests of methamphetamine dealers and bank robbers these days often look much like a tactical assault on insurgents in Baghdad.

A decade after the Sept. 11, 2001, attacks on the World Trade Center and the Pentagon, federal and state governments are spending about $75 billion a year on domestic security, setting up sophisticated radio networks, upgrading emergency medical response equipment, installing surveillance cameras and bombproof walls, and outfitting airport screeners to detect an ever-evolving list of mobile explosives.

But how effective has that 10-year spending spree been?

“The number of people worldwide who are killed by Muslim-type terrorists, Al Qaeda wannabes, is maybe a few hundred outside of war zones. It’s basically the same number of people who die drowning in the bathtub each year,” said John Mueller, an Ohio State University professor who has written extensively about the balance between threat and expenditures in fighting terrorism.

“So if your chance of being killed by a terrorist in the United States is 1 in 3.5 million, the question is, how much do you want to spend to get that down to 1 in 4.5 million?” he said.

One effect is certain: Homeland Security spending has been a pump-primer for local governments starved by the recession, and has dramatically improved emergency response networks across the country.

An entire industry has sprung up to sell an array of products, including high-tech motion sensors and fully outfitted emergency operations trailers. The market is expected to grow to $31 billion by 2014.

Like the military-industrial complex that became a permanent and powerful part of the American landscape during the Cold War, the vast network of Homeland Security spyware, concrete barricades and high-tech identity screening is here to stay. The Department of Homeland Security, a collection of agencies ranging from border control to airport security sewn quickly together after Sept. 11, is the third-largest Cabinet department and — with almost no lawmaker willing to render the U.S. less prepared for a terrorist attack — one of those least to fall victim to budget cuts.

The expensive and time-consuming screening now routine for passengers at airport boarding gates has detected plenty of knives, loaded guns and other contraband, but it has never identified a terrorist who was about to board a plane. Only 14 Americans have died in about three dozen instances of Islamic extremist terrorist plots targeted at the U.S. outside war zones since 2001 — most of them involving one or two home-grown plotters.

Homeland Security officials say there is no way to compute how many lives might have been lost had the nation’s massive security apparatus not been put into place — had the would-be bombers not been arrested before they struck, or deterred from getting on a plane because it was too hard.

“We know that they study our security measures, we know they’re continuously looking for ways to get around them, and that’s a disincentive for someone to carry out an attack,” said John Cohen, the department’s deputy counter-terrorism coordinator.

“Another way of asking the question is: Has there been a U.S. airplane that has exploded?”

State and local emergency responders have undergone a dramatic transformation with the aid of $32 billion that has been dispensed in Homeland Security grants since 2002, much of it in the early years spent on Hollywood-style tactical gear, often with little connection between risk and outlay.

“After 9/11, it was literally like my mother running out the door with the charge card,” said Al Berndt, assistant director of the Emergency Management Agency in Nebraska, which has received $163.7 million in federal anti-terrorism and emergency aid grants. “What we really needed to be doing is saying, ‘Let’s identify the threat, identify the capability and capacity you already have, and say, OK, what’s the shortfall now, and how do we meet it?’ ”

The spending has been rife with dubious expenditures, including the $557,400 in rescue and communications gear that went to the 1,500 residents of North Pole, Alaska, and a $750,000 anti-terrorism fence — fashioned with 8-foot-high ram-proof wrought iron reinforced with concrete footers — built around a Veterans Affairs hospital in the pastoral hills outside Asheville, N.C.

West Virginia got $3,000 worth of lapel pins and billed the federal government for thousands of dollars in cellphone charges, according to the Center for Investigative Reporting, which compiled a state-by-state accounting of Homeland Security spending. In New York, $3 million was spent on automated public health records to help identify bioterrorism threats, but investigators for the department’s inspector general in 2008 found that employees who used the program weren’t even aware of its potential bioterrorism applications.

A little house of secrets on the Great Plains

The secretive business havens of Cyprus and the Cayman Islands face a potent rival: Cheyenne, Wyoming.

At a single address in this sleepy city of 60,000 people, more than 2,000 companies are registered. The building, 2710 Thomes Avenue, isn’t a shimmering skyscraper filled with A-list corporations. It’s a 1,700-square-foot brick house with a manicured lawn, a few blocks from the State Capitol.

Neighbors say they see little activity there besides regular mail deliveries and a woman who steps outside for smoke breaks. Inside, however, the walls of the main room are covered floor to ceiling with numbered mailboxes labeled as corporate “suites.” A bulky copy machine sits in the kitchen. In the living room, a woman in a headset answers calls and sorts bushels of mail.

A Reuters investigation has found the house at 2710 Thomes Avenue serves as a little Cayman Island on the Great Plains. It is the headquarters for Wyoming Corporate Services, a business-incorporation specialist that establishes firms which can be used as “shell” companies, paper entities able to hide assets.

Wyoming Corporate Services will help clients create a company, and more: set up a bank account for it; add a lawyer as a corporate director to invoke attorney-client privilege; even appoint stand-in directors and officers as high as CEO. Among its offerings is a variety of shell known as a “shelf” company, which comes with years of regulatory filings behind it, lending a greater feeling of solidity.

“A corporation is a legal person created by state statute that can be used as a fall guy, a servant, a good friend or a decoy,” the company’s website boasts. “A person you control… yet cannot be held accountable for its actions. Imagine the possibilities!”

Among the entities registered at 2710 Thomes, Reuters found, is a shelf company sheltering real-estate assets controlled by a jailed former prime minister of Ukraine, according to allegations made by a political rival in a federal court in California.

The owner of another shelf company at the address was indicted in April for allegedly helping online-poker operators evade a U.S. ban on Internet gambling. The owner of two other firms there was banned from government contracting in January for selling counterfeit truck parts to the Pentagon.

All the activity at 2710 Thomes is part of a little-noticed industry in the U.S.: the mass production of paper businesses. Scores of mass incorporators like Wyoming Corporate Services have set up shop. The hotbeds of the industry are three states with a light regulatory touch-Delaware, Wyoming and Nevada.

The pervasiveness of corporate secrecy on America’s shores stands in stark contrast to Washington’s message to the rest of the world. Since the September 11 attacks in 2001, the U.S. has been calling forcefully for greater transparency in global transactions, to lift the veil on shadowy money flows. During a debate in 2008, presidential candidate Barack Obama singled out Ugland House in the Cayman Islands, reportedly home to some 12,000 offshore corporations, as “either the biggest building or the biggest tax scam on record.”

Yet on U.S. soil, similar activity is perfectly legal. The incorporation industry, overseen by officials in the 50 states, has few rules. Convicted felons can operate firms which create companies, and buy them with no background checks.

Libyan gold rush followed end to sanctions

The Washington Post reports:

Some of the world’s most sophisticated banks and investment firms rushed to do business with Moammar Gaddafi’s government in Libya after the United States rescinded the country’s designation as a state sponsor of terrorism five years ago, according to an internal financial document obtained by The Washington Post.

HSBC, Goldman Sachs and other top banks took on hundreds of millions in cash deposits. Hedge funds and private investment firms, including the Washington-based Carlyle Group, sold Libya’s investment authority complex financial products. The Libyan sovereign wealth fund bought more than $1 billion in U.S. Treasury bills, effectively giving Libya a chance to underwrite U.S. debt.

By last year, Libya’s fund recorded about $56 billion in assets around the world, the internal document shows.

The document, created for the Tripoli-based Libyan Investment Authority by management consulting firm KPMG, provides the most detailed accounting yet of how Libya invested its oil revenue in the years between its removal from the international blacklist in 2006 and the resumption of sanctions after a deadly crackdown on protesters earlier this year.

The report underscores that just months after Gaddafi’s government was cleared for international business deals, leading financial institutions were courting Gaddafi officials for access to a huge new reservoir of capital — more than $40 billion at the time.

The gold rush in Libya occurred with encouragement from U.S. officials, who wanted to reward Gaddafi for pledging to honor international law, disavow terrorism and compensate relatives of victims of the Pan Am Flight 103 bombing.

Why isn’t Wall Street in jail?

Matt Taibbi writes:

Over drinks at a bar on a dreary, snowy night in Washington this past month, a former Senate investigator laughed as he polished off his beer.

“Everything’s fucked up, and nobody goes to jail,” he said. “That’s your whole story right there. Hell, you don’t even have to write the rest of it. Just write that.”

I put down my notebook. “Just that?”

“That’s right,” he said, signaling to the waitress for the check. “Everything’s fucked up, and nobody goes to jail. You can end the piece right there.”

Nobody goes to jail. This is the mantra of the financial-crisis era, one that saw virtually every major bank and financial company on Wall Street embroiled in obscene criminal scandals that impoverished millions and collectively destroyed hundreds of billions, in fact, trillions of dollars of the world’s wealth — and nobody went to jail. Nobody, that is, except Bernie Madoff, a flamboyant and pathological celebrity con artist, whose victims happened to be other rich and famous people.

The rest of them, all of them, got off. Not a single executive who ran the companies that cooked up and cashed in on the phony financial boom — an industrywide scam that involved the mass sale of mismarked, fraudulent mortgage-backed securities — has ever been convicted. Their names by now are familiar to even the most casual Middle American news consumer: companies like AIG, Goldman Sachs, Lehman Brothers, JP Morgan Chase, Bank of America and Morgan Stanley. Most of these firms were directly involved in elaborate fraud and theft. Lehman Brothers hid billions in loans from its investors. Bank of America lied about billions in bonuses. Goldman Sachs failed to tell clients how it put together the born-to-lose toxic mortgage deals it was selling. What’s more, many of these companies had corporate chieftains whose actions cost investors billions — from AIG derivatives chief Joe Cassano, who assured investors they would not lose even “one dollar” just months before his unit imploded, to the $263 million in compensation that former Lehman chief Dick “The Gorilla” Fuld conveniently failed to disclose. Yet not one of them has faced time behind bars.

America’s feudal friends

As the saying goes, a man is known by the company he keeps. President Obama’s choice of Frank Wisner as his special envoy to Cairo shows that corruption has become so deeply institutionalized in Washington that it cannot be exposed — it is so commonplace, so much regarded as an inherent dimension of politics that politics and corruption are indivisible. The fact that bundles of unmarked bills in brown paper bags are rarely exchanged for political services is not evidence of a clean political system. On the contrary: it is evidence that corruption has been legalized.

Robert Fisk writes:

Frank Wisner, President Barack Obama’s envoy to Cairo who infuriated the White House this weekend by urging Hosni Mubarak to remain President of Egypt, works for a New York and Washington law firm which works for the dictator’s own Egyptian government.

Mr Wisner’s astonishing remarks – “President Mubarak’s continued leadership is critical: it’s his opportunity to write his own legacy” – shocked the democratic opposition in Egypt and called into question Mr Obama’s judgement, as well as that of Secretary of State Hillary Clinton.

The US State Department and Mr Wisner himself have now both claimed that his remarks were made in a “personal capacity”. But there is nothing “personal” about Mr Wisner’s connections with the litigation firm Patton Boggs, which openly boasts that it advises “the Egyptian military, the Egyptian Economic Development Agency, and has handled arbitrations and litigation on the [Mubarak] government’s behalf in Europe and the US”. Oddly, not a single journalist raised this extraordinary connection with US government officials – nor the blatant conflict of interest it appears to represent.

Mr Wisner is a retired State Department 36-year career diplomat – he served as US ambassador to Egypt, Zambia, the Philippines and India under eight American presidents. In other words, he was not a political appointee. But it is inconceivable Hillary Clinton did not know of his employment by a company that works for the very dictator which Mr Wisner now defends in the face of a massive democratic opposition in Egypt.

So why on earth was he sent to talk to Mubarak, who is in effect a client of Mr Wisner’s current employers?

Patton Boggs states that its attorneys “represent some of the leading Egyptian commercial families and their companies” and “have been involved in oil and gas and telecommunications infrastructure projects on their behalf”. One of its partners served as chairman of the US-Egyptian Chamber of Commerce promoting foreign investment in the Egyptian economy. The company has also managed contractor disputes in military-sales agreements arising under the US Foreign Military Sales Act. Washington gives around $1.3bn (£800m) a year to the Egyptian military.

Mr Wisner joined Patton Boggs almost two years ago – more than enough time for both the White House and the State Department to learn of his company’s intimate connections with the Mubarak regime. The New York Times ran a glowing profile of Mr Wisner in its pages two weeks ago – but mysteriously did not mention his ties to Egypt.

Nicholas Noe, an American political researcher now based in Beirut, has spent weeks investigating Mr Wisner’s links to Patton Boggs. Mr Noe is also a former researcher for Hillary Clinton and questions the implications of his discoveries.

“The key problem with Wisner being sent to Cairo at the behest of Hillary,” he says, “is the conflict-of-interest aspect… More than this, the idea that the US is now subcontracting or ‘privatising’ crisis management is another problem. Do the US lack diplomats?

“Even in past examples where presidents have sent someone ‘respected’ or ‘close’ to a foreign leader in order to lubricate an exit,” Mr Noe adds, “the envoys in question were not actually paid by the leader they were supposed to squeeze out!”

While the rationalization provided by so-called political realism ascribes US support for Mubarak to the need for “stability” in an unstable region, he also belongs to the class of leaders America has always preferred to support: those unburdened by ideological affiliations whose insatiable greed makes them dependable US allies. In other words, the US government likes rulers who are so rotten they can be trusted — which is to say, trusted to serve US interests.

What does this tell us about American values and the American view of the world?

That every man can be bought — it’s just a matter of finding the right price.

It’s not a mentality one would hope to find in the cradle of modern democracy but hardly surprising to be seen prevailing in a nation built on slavery.

There is of course nothing uniquely American in this mentality — it’s the way imperial powers have always extended their reach, but as Barack Obama said on the day of his inauguration, “the world has changed and we must change with it.”

Indeed. But, if his response to the Egyptian revolution provides a reliable measure, we have yet more evidence this president lacks the will to become the agent of such change.

Salwa Ismail writes:

There is a lot more behind Hosni Mubarak digging in his heels and setting his thugs on the peaceful protests in Cairo’s Tahrir Square than pure politics. This is also about money. Mubarak and the clique surrounding him have long treated Egypt as their fiefdom and its resources as spoils to be divided among them.

Under sweeping privatisation policies, they appropriated profitable public enterprises and vast areas of state-owned lands. A small group of businessmen seized public assets and acquired monopoly positions in strategic commodity markets such as iron and steel, cement and wood. While crony capitalism flourished, local industries that were once the backbone of the economy were left to decline. At the same time, private sector industries making environmentally hazardous products like ceramics, marble and fertilisers have expanded without effective regulation at a great cost to the health of the population.

A tiny economic elite controlling consumption-geared production and imports has accumulated great wealth. This elite includes representatives of foreign companies with exclusive import rights in electronics, electric cables and automobiles. It also includes real estate developers who created a construction boom in gated communities and resorts for the super-rich. Much of this development is on public land acquired at very low prices, with no proper tendering or bidding.